Whether it is your first time, tenth time, or twentieth time filing your personal income tax, the process can be fairly frustrating, confusing, and cumbersome.

Here is your quick and essential guide to filing personal income tax in Singapore, where we have collated all the important information, links to different sections on taxation, and guides on filing, so that you don’t have to crack your head over this when March comes.

So, read on!

(Click here if you want to know more about corporate income tax in Singapore.)

Who Has to Pay Income Taxes in Singapore?

There are two groups of income taxpayers: residents and non-residents.

Generally, you are a tax resident if you fall into these categories:

- Singapore Citizens and Singapore Permanent Residents (PRs)

- Foreigners who have worked in Singapore for at least 183 days in the previous calendar year or continuosly for three consecutive years

If you don’t fall into those two categories, you are likely to be a non-resident. Check out this IRAS page to be sure.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What Types of Incomes Are Taxable and What Are Not?

Given the rise of the gig economy, freelancing, and remote work, you might be wondering what types of income are taxable.

If you are a salaried employee, it is likely that you receive an auto-filled income tax filing for the salary you earn. However, it is important to note that even if you are a salaried employee, any gig work or income you earn on the side is taxable. This may include:

- Income from employment

- Income received from trade, business, profession or vocation

- Income from property or investments

- Any other sources of income

How Much Income Tax Do You Have to Pay?

The amount of income tax you are liable to pay is dependent on your status as a tax resident.

If you are considered a non-resident, employment income earned is taxed at a fixed rate of 15% or the progressive tax rate (see below), whichever is higher. For other types of income, such as director’s remuneration, they may be taxed at a fixed rate of 22%.

If your status is a tax-resident (which most of us are under), your income is taxed at the progressive resident income tax rate.

You can use the below table to calculate your tax payable:

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

|---|---|---|

| First $20,000 Next $10,000 | 0 2 | 0 200 |

| First $30,000 Next $10,000 | – 3.50 | 200 350 |

| First $40,000 Next $40,000 | – 7 | 550 2,800 |

| First $80,000 Next $40,000 | – 11.5 | 3,350 4,600 |

| First $120,000 Next $40,000 | – 15 | 7,950 6,000 |

| First $160,000 Next $40,000 | – 18 | 13,950 7,200 |

| First $200,000 Next $40,000 | – 19 | 21,150 7,600 |

| First $240,000 Next $40,000 | – 19.5 | 28,750 7,800 |

| First $280,000 Next $40,000 | – 20 | 36,550 8,000 |

| First $320,000 In excess of $320,000 | – 22 | 44,550 |

Using Tax Deductions to Reduce Your Income Tax

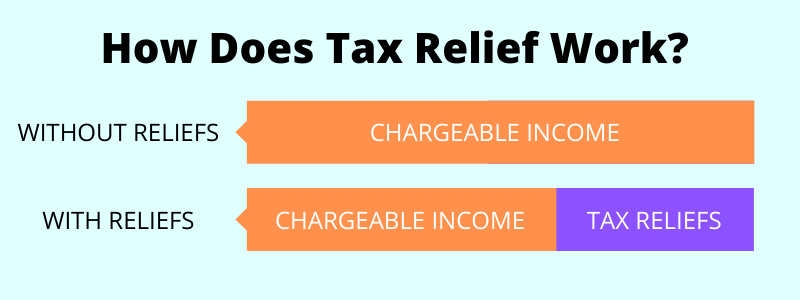

However, most people pay less than the gross tax payable. This is because of the various tax deductions and reliefs available for all tax residents.

It pays off to know what tax deductions you can utilise to reduce your income tax, as this can mean saving hundreds or even thousands of dollars, and for some working mothers, this might also mean not having to pay income tax at all.

Among the different types of tax deductions and reliefs, the ones available for most Singaporeans are as follows:

- Donations

- Working Mother’s Child Relief

- Earned Income Relief

- CPF Relief

- NS-man Related Relief

- Supplementary Retirement Scheme (SRS) Relief

Personal income tax reliefs do have a limit of $80,000.

Putting It All Together: How to Calculate Income Tax Payable

Still confused on how this works?

Let’s look at Mr Tan’s profile for a quick illustration. An unmarried man, Mr Tan earned a salaried income of $60,000. He also engaged in some gig work that earned him about $5,000.

Troubled by how Covid-19 impacted the local community, he decided to donate $300 through an organisation that is under an approved Institution of Public Charter (IPC). He also qualified for a total of $12,000 in tax reliefs.

Here’s a summary:

| Earned Income | $65,000 |

| Tax Deductions ($300 Donation) | – $750 |

| Tax Reliefs (NSman, CPF, etc) | – $12,000 |

| Chargeable Income | $52,250 |

How much tax does he have to pay? The amount of tax payable depends on the chargeable income. Looking at the income tax table above, Mr Tan is in the third income tax bracket, which charges $550 for the first $40,000, and a 7% tax rate for the next $40,000.

This means that he has to pay a total income tax of: $550 + (7% x $12,250) = $1,407.50.

If this is too complex for you, you can simply use the tax calculator.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

How Do You File Your Income Taxes?

Filing income taxes have become a breeze thanks to the Internet.

It has become so seamless, especially if your employer is enrolled under the Auto-Inclusion Scheme (AIS). All you have to do is it check if the different sections are filled out correctly, and to claim the tax deductions you are entitled for. E-filing is done via the IRAS Portal, and simply requires your SingPass to log in and submit the filing.

However, if you don’t like electronic methods, IRAS also provides you with the option to fill up a paper form. Simply access the IRAS website, and print the relevant documents that you need to fill up. They have also attached a guide that will enable you to fill up the form accurately.

When’s the Deadline for Income Tax Filing?

Don’t miss the deadline for filing income tax.

All who are liable to pay for income tax will receive a notification from 1 March that income tax filing can begin. The hard deadline for e-filing is 18 April, while those who choose to do it via paper forms will have to submit and mail out the forms by 15 April.

How to Pay Your Taxes?

Filed your taxes and confused about the payment modes? IRAS offers a suite of payment selections.

The preferred mode of payment is via GIRO, and you can choose to pay either a lump sum, or through an interest-free 12 month installment.

Alternatively, you can select the various e-payment modes available (PayNow/I-Banking etc.), payment via credit card, and even via telegraphic transfer.

What Happens If You Miss the Deadline, Fail to Pay, or Under-Declare Taxes?

Even if you can’t wrap your head around why you should pay for tax, don’t risk missing the deadline, under-declaring, or simply refusing the pay your taxes. There are serious penalties for this.

Late payment will result in a 5% penalty on the unpaid tax. If you continue to miss the payment deadline, you can be charged up to a 12% penalty.

If you refuse to pay your taxes, be prepared to face the following consequences:

- Your bank, employer or tenants will be forced to pay for you

- You will not be allowed to travel out of Singapore (Travel Restriction Order)

- You will be served legal papers

If you’re thinking about underdeclaring your taxable income, you are strongly advised not to be penny wise, pound foolish. Under-declaration of taxes is considered tax evasion or fraud. This is a criminal offence. Being chargered with serious fraudulent tax evasion may result in a fine not exceeding $50,000 and/or up to seven years of imprisonment.

Final Thoughts

Paying income tax is an inescapable requirement of most citizens around the world, and it would be wise to adhere to the rules and regulations surrounding this.

The best advice we can give is to declare accurately, study how to maximise tax deductions you are entitled for, and to file on time!