3 Best CareShield Life Supplements in Singapore (Comparison for 2021)

…Compare and Save PRECIOUS Time & Money

1179+ Singaporeans have benefitted from our comparisons

- Avoid multiple agents yet be able to compare across 15 insurance companies

- Our DeepDive™ provides an in-depth comparison of the best CareShield upgrades in Singapore

- Tailored to your specific needs with personalised quotes and premiums

- Get a higher monthly payout by just paying premiums with your CPF MediSave

This page is part of the CareShield Life 3-Part Series:

- Part 0: ElderShield vs CareShield Life

- Part 1: What is CareShield Life?

- Part 2: CareShield Life Supplement

- Part 3: Best CareShield Life Supplement

The Purpose of a CareShield Life Supplement

The basic CareShield Life only provides a minimum safety net. It pays out $600/month if a severe disability happens in 2020.

Most would think that this amount is low, and is insufficient for their needs.

With a CareShield Life supplement, you’re able to get a higher monthly coverage amount without the need of paying cash premiums, as you’re able to utilise your CPF MediSave balance.

As such, you’re able to get better protection for you and your loved ones.

Finding the Best CareShield Life Upgrade in Singapore

If you like the idea of CareShield supplements, what’s next?

Finding the best one of course!

You’re using your hard-earned money and you’ll definitely want to make the best decision (with no regrets in the future).

But CareShield upgrades come in all shapes and sizes… and one size doesn’t fit all.

The only way to find the best one for you is to do an in-depth comparison across the different plans offered by the different insurance companies.

And that’s what we’re good at.

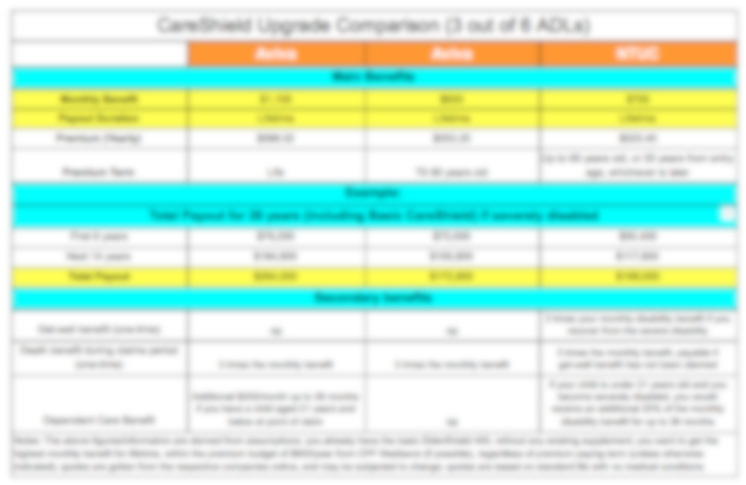

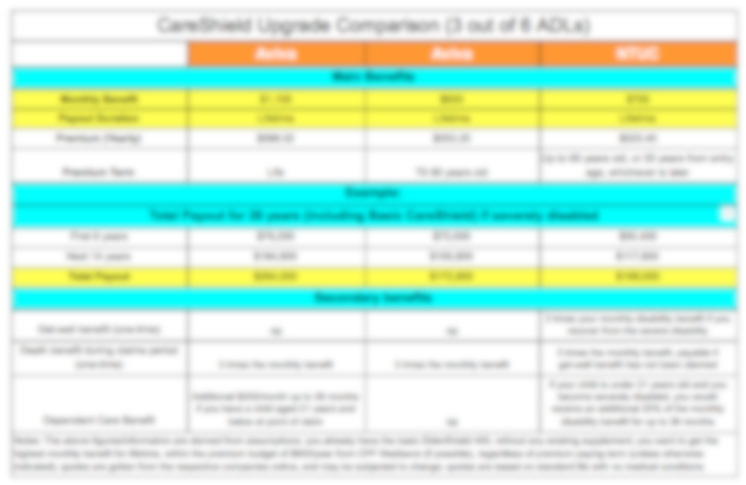

What’s in Our CareShield Upgrade DeepDive™

Unlike others, our DeepDive™ gives you the Good and the Bad…

So you will be equipped to make better decisions.

What we’ll cover in the comparison:

- The monthly coverage amount if you intend to just use your CPF MediSave to pay the premiums

- How much are the premiums

- Any secondary benefits

- Potential disadvantages

- Anything else you wish to know…

We spent hours scrutinising policy documents so that you don’t have to.

3 Reasons Why We Need to Meet

You just want to look at the numbers… you got no time… you don’t want to meet strangers.

Perhaps you’re here because you were doing research online or came looking for more information when someone – friend or agent – told you about this.

So you may thinking, “just email the comparison and quotes to me!“

As consumers ourselves, we understand the convenience of that.

But a mere comparison table will not help you make a concrete decision (one that you can set in stone).

Here are 3 reasons why there’s a need to meet:

1) Give Accurate Recommendations

Can you be absolutely sure of what you want? Could there be something that you may have missed?

A wrong decision might lead to a lifetime of regrets.

If you go to a doctor and without asking you anything, the doctor gives you medicine for this, this and this.

Would you have full confidence in the solution? No.

And that’s why there’s a need to understand your situation first BEFORE we give a recommendation – we’re not in the business of pushing products.

2) Requirement of MAS

In the Financial Advisers Act, it is stated that in order for a recommendation to be made, information on the client has to be gathered first.

Any inaccurate or incomplete information may affect the suitability of the recommendation.

Over the years, MAS has imposed stricter regulations to ultimately protect Singaporeans (and that includes you).

It is there for a reason and that is to ensure that you don’t end up with an unsuitable plan.

3) Touch on Fine Prints

What’s the purpose of a comparison table?

It’s to present information in an organised and simple way, so that you can make a decision based on it.

But can you really make an informed decision from it?

If you can easily do that, there wouldn’t be a need for two-digit pages of policy documents (for just one plan).

There are fine prints and clauses that might make or break your decision.

And that’s why we meet to not only show you the comparisons but to go through any critical pointers that you MUST be aware of.

We don’t want to overpromise and underdeliver.

We Compare 15 Insurance Companies to Find the Best Plan for Your Needs

This is GREAT if you:

Our Trusted Providers

- AIA

- Singlife with Aviva

- Friends Provident

- China Life

- Generali Worldwide

- China Taiping

- NTUC Income

- Manulife

- LIC

- Old Mutual

- Swiss Life

- HSBC Life

- AXA

- Tokio Marine

- Singlife

- Transamerica

- Etiqa

- FWD

Yes, there’s no fee involved.

It typically takes around 40 minutes. However, it can take even longer if there are questions from your side or more complex situations.

We’re providing solutions that suit your needs. In the end, it’s entirely up to you to decide.

Yes! If you do have old policies, do bring them along as we can give a more accurate feedback.