While most Singaporeans know the exact percentage they pay for the Goods and Services Tax (GST), many can’t recall the personal income tax rate offhand.

Singapore’s GST is currently pegged at 7% and set to increase in the coming years, but what about the personal income tax rate?

If you are a tax resident in Singapore, you can heave a huge sigh of relief – while Singaporeans don’t rank first in terms of lowest income tax rate, they can also be thankful that they are not tax residents of Sweden. The highest income earners in Sweden can be taxed as much as 57.1%.

So where does Singapore rank in terms of income tax, and how much tax can you expect to pay throughout your lifetime in Singapore?

Who’s Considered a Tax Resident in Singapore?

The first thing that you must know, is whether you are considered a tax resident in Singapore.

All Singaporeans and permanent residents (PRs) are automatically considered tax residents unless they are temporarily absent from the country for work or other purposes.

You’re also considered a tax resident if you’re a foreigner who has stayed/worked in Singapore for at least 183 days in the previous calendar year or continuously for three consecutive years.

In most cases, if you do not meet the two categories mentioned above, you will be treated as a non-resident.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

Personal Income Tax Rates for Residents

So, what is the income tax rate like for those considered residents of Singapore?

It is important to note that the personal income tax rate is not like the GST. GST has a fixed rate – regardless of your socio-economic status and gross income, all residents pay 7% (as of 2022).

However, the personal income tax rate is not a flat rate. Residents progressively pay more personal income tax as their income grows.

Based on your current income, which bracket do you fall under?

The Inland Revenue Authority of Singapore (IRAS) provides a helpful table for all residents to discern their tax rate. In the table below, you can find the income tax rate related to your chargeable income.

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

|---|---|---|

| First $20,000 Next $10,000 | 0 2 | 0 200 |

| First $30,000 Next $10,000 | – 3.50 | 200 350 |

| First $40,000 Next $40,000 | – 7 | 550 2,800 |

| First $80,000 Next $40,000 | – 11.5 | 3,350 4,600 |

| First $120,000 Next $40,000 | – 15 | 7,950 6,000 |

| First $160,000 Next $40,000 | – 18 | 13,950 7,200 |

| First $200,000 Next $40,000 | – 19 | 21,150 7,600 |

| First $240,000 Next $40,000 | – 19.5 | 28,750 7,800 |

| First $280,000 Next $40,000 | – 20 | 36,550 8,000 |

| First $320,000 In excess of $320,000 | – 22 | 44,550 |

How to Calculate Your Income Tax

If it is your first year paying taxes, the numbers in the table can be quite confusing. How do you calculate your income tax, and what is considered chargeable income?

If you earn rental income or have a side hustle, these are considered as part of your personal income and will thus be taxable.

While many residents assume that interpreting the table is as simple as finding which income bracket they are in, and then calculating the tax from there, that’s not actually how the income tax is calculated.

The first $20,000 is always not charged – therefore, this needs to be taken into consideration.

Let’s assume that you earned $100,000 for the year of assessment. How then do you calculate your effective income tax rate and total income tax due to IRAS?

Simply look at the bracket you belong to. In this case, you belong to bracket four, where your first $80,000 is taxed, and you have to pay $3,350. The next $40,000 will be taxed at 11.5%. This means that the total amount of tax due is $3,350 + ($20,000 x 11.5%) = $5,650.

If this is too complex for you, simply use the IRAS calculator which also includes a formula to calculate the tax reliefs you are eligible for.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

What’s the Effective Tax Rate in Singapore?

So what’s the real tax rate for each individual? If we look at the tax payable for a $100,000 income-earner, it is only 5.65% ($5,650 / $100,000), not 11.5% of the total income as expected.

This is because the first $20,000 is always not taxed. And the tax rates increase progressively as you earn more.

Here are the effective tax rates on various income earned:

| Chargeable Income | Tax Payable | Effective Income Tax Rate |

| $20,000 | $0 | 0% |

| $40,000 | $550 | 1.38% |

| $80,000 | $3,350 | 4.19% |

| $100,000 | $5,650 | 5.65% |

| $160,000 | $13,950 | 8.72% |

| $200,000 | $21,150 | 10.58% |

| $240,000 | $28,750 | 11.98% |

| $280,000 | $36,550 | 13.05% |

| $320,000 | $44,550 | 13.92% |

Personal Income Tax Rates for Non-Residents

If you are an expat living in Singapore, or considering to work in Singapore for more than 183 days (that works out to about 6 months), you might be wondering if the same rates apply to you. In this case, you can rejoice, as you are eligible for this progressive model.

However, if you work fewer than 183 days, you are considered a non-resident. In this case, if you have earned income during your stay in Singapore, you are liable to pay a 15% flat rate or the progressive tax rate model, whichever is higher.

If you hold a higher management position such as a Director, fees may be subjected to a 22% tax rate. Non-residents also don’t qualify for personal tax reliefs.

How to Reduce Income Tax?

Have you calculated how much tax you have to pay for this year of assessment? Are you already feeling the pinch?

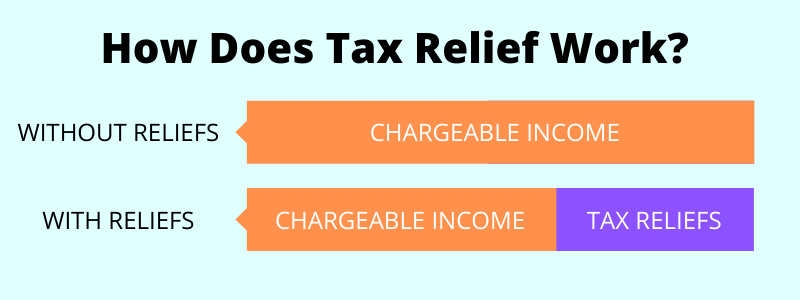

If you are considered a resident in Singapore, you are eligible for tax reliefs and tax deductions.

It pays to do some of your math now, so that you can strategise and find ways to reduce the total income tax payable.

In fact, Singapore rewards you for taking ownership of your own savings – if you do a cash top-up to your own CPF or contribute to your SRS account, you get to deduct the same amount you put in, from your total chargeable income, subject to limits.

If that doesn’t sit well with you, you can also choose to donate to the approved charities and be rewarded with a 250% tax deduction (i.e., for every $10 donated, you can deduct $25 from your total taxable income).

Apart from these methods, you can also check which personal reliefs you are eligible for, especially if you care for elderly parents, siblings and have children. However, there is a cap of $80,000 of personal tax reliefs.