The world was recently reeling from the news that Bill and Melinda Gates are divorcing after 27 years of marriage.

Apart from being shocked that such a decision has been made after having three kids and having journeyed through 27 long years of marriage, people are also interested in how their net worth will change after the divorce as they split assets and family wealth. According to some studies, Bill Gates’ net worth is currently standing at 129.7 billion USD, while Melinda’s net worth is 2.9 billion USD.

You might be thinking that such calculations make sense for the wealthy, however, is it relevant at all for the average Singaporean?

I would like to propose that tracking your net worth is an important part of financial planning and will help you to achieve your financial goals in the long run.

What is Net Worth?

Net worth is often used to refer to the “total value of assets that a company owns, minus the liabilities they owe”. This calculation is important for both company owners and shareholders as it is an accurate metric to assess the financial health of the company. Just like companies, calculating the net worth of an individual will also give you a good sense of your own financial health.

In order to calculate net worth, one must have a good understanding of what an asset and liability constitutes.

An asset refers to anything that has financial value. This can include things like property, shares and bank balances.

A liability refers to debt. This will include loans, mortgages and your monthly credit card balances.

How to calculate your net worth? In order to do so, you will need to know the current value of your assets and your liabilities. A simple formula to calculate your net worth would be:

Net Worth = Total Assets – Total Liabilities

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What Are the Common Assets and Liabilities a Singaporean Has?

Thanks to our unique policies in Singapore, there is more to one’s assets and liabilities compared to our peers in Western countries. You will need to know these figures before doing your calculations in order to get an accurate picture of your financial standing.

Most Common Assets of Singaporeans

If you have been working and are in your late twenties and beyond, these are the likely assets you might have in your possession:

- Property (HDB Flat/ Condominium/ Landed)

- Real Estate Investments (e.g. a property you bought from another country for investment)

- Financial Investments (stocks and shares, ETFs, unit trusts, bonds, life policies, fixed deposits)

- Cash Flow (bank balances in your Savings/ Current account)

- CPF (balances in your Ordinary Account, Special Account, Medisave, Retirement and SRS)

- Motor Vehicles (e.g. car/motorcycle)

Most Common Liabilities of Singaporeans

These are the likely liabilities that you may have:

- Mortgage Loans

- Study Loans

- Renovation Loans

- Car/Motorcycle Loan

- Income Tax

What Is Considered a High-Net-Worth Individual in Singapore?

In most countries, a high-net-worth individual (HNWI) is any individual considered to have a net worth of at least a million dollars. According to the Credit Suisse Research Institute, there are 269,925 people in Singapore who are millionaires.

There are also statistics on ultra-high-net-worth individuals (UHNWI). According to the same study, UHNWIs have a net worth of at least US$50 million. In 2020, there were 1,361 people who qualified to be considered UHNWIs.

To add, Singapore has one of the highest average wealth per adult in the world.

Although there is no hard criterion in Singapore to be considered a high-net-worth individual, we can get some ideas about different tiers of HNWIs from the way banks serve their customers.

In the following table, we compare 3 different banks in Singapore and their different tiers of wealth banking services. Tier 1 would constitute customers with access to the most privileged banking services, while Tier 3 constitutes those who have access to the most basic privileged banking services after the average Singaporean who only has a basic Savings/Current Account.

| Bank | Tier 1 | Tier 2 | Tier 3 |

| DBS | $5 million investible assets (DBS Private Bank) | $1.5 million investible assets (DBS Treasure Private) | $350,000 investible assets (DBS Treasures) |

| OCBC | – | $1 million (OCBC Premier Private) | $200,000 (OCBC Premier Banking) |

| UOB | – | $2 million (UOB Privilege Reserve) | $350,000 (UOB Privilege Banking) |

From the data above, we can deduce that a HNWI in Singapore would be considered to have an average of $1.5 million Singapore Dollars in investible assets. It seems that among the three banks, DBS is the only one that has an added privilege service for high(er)-net-worth individuals. These individuals may well be on their way to becoming UHNWIs.

2 Tools to Help You Calculate Your Net Worth

Interested to find out if you qualify for HNWI status or how close you are to getting there? Here are two simple tools to help you calculate your net worth easily.

1) Net Worth Calculator

If you would like a quick and easy way to calculate your net worth, this is the calculator for you. All you need to do is to enter the data into the different categories, and our online calculator will produce your net worth data instantly.

2) FinSnap (Excel template)

If you would like to keep track of your net worth over time, we have designed a free Excel sheet template for you to capture all your data neatly. FinSnap stands for “Track and Safe Keep”. Our template allows you to input data into the following sections:

- Assets & Liabilities

- Income & Expenses

- Insurance Policy Summary

- Other Essential Information

FinSnap not only allows you to keep track of and improve your finances but can also function as an important document for your family to refer to. This is especially helpful when the inevitable comes at an inopportune time. In the link above, you will also find more tips on how to use FinSnap and how it can be helpful to your family and loved ones.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

3 Reasons Why You Should Track Your Net Worth on a Regular Basis

While it might seem like a hassle to track your net worth, doing so has long-term benefits. It is worth keeping track of your net worth at least once a year for the following reasons:

1) To understand your current financial standing

Tracking your net worth is akin to generating a report card to evaluate your financial health. The exact number itself can give you an idea of your current financial standing. More importantly, the individual data imputed, such as your total assets and total liabilities, can also give you insight of your current lifestyle and habits.

2) To measure how far away you are from your financial goals

All of us want to be able to retire comfortably. With Singapore’s high cost of living (here are some reasons why it is so), having a clear retirement plan is important. Your current net worth will give you an idea of how far away you are from your goals, and what changes you need to make in terms of your spending or earning to achieve it by the time you want to retire (whether that’s at age 35 or 65).

3) To provide data for your family members

Even though we do not like to think of death, it is an inevitability. Estate planning is not just for the old, but for everyone. If we happen to die suddenly, tracking your net worth on a regular basis provides an easy way for your family members to access your financial information. This can ease their burdens in sorting out these financial aspects and allow them time and space to grieve. Furthermore, with the current trend on investing in cryptocurrencies, it becomes even more pertinent to keep track of this data (and where you have kept it), otherwise, it will be lost forever.

4 Ways to Increase Your Net Worth in Singapore

If you have calculated your data and you are wondering how to increase your net worth, these are four possibilities for you.

1) Earn More

We can’t run away from the fact that our income is the biggest factor that would help us to increase our net worth. If you are employed, you would want to invest in some time to upskill, train for leadership positions or dive into specialised areas, in order to become a valuable asset to your company and negotiate for more opportunities and a higher salary.

Some others have also embarked on side hustles such as giving tuition, providing freelance services and turning their hobbies into possible money-earning avenues. Think about your options and how you can turn these into ways to increase your cash flow. Some Singaporeans have also embarked on things like dog-sitting, running a home-baking business on weekends and babysitting, which can give them a pretty sum every month.

2) Protect More

In such uncertain times, it has become even more important to ensure that your income is protected. Many Singaporeans have lost their jobs because of the pandemic. If you are still employed, it is imperative to find ways to protect yourself from losing your income. Apart from keeping healthy and well, you should also ensure that you have adequate insurance coverage that would provide you with cash flow in case you are permanently disabled, unable to work, or are struck with any critical illness. Without protection, these can wipe out your savings completely.

3) Save More (Spend Less)

You can’t increase your net worth unless you can save more and reduce your liabilities. Many Singaporeans find this difficult because of our increasing cost of living. While many have bemoaned millennial’s choices such as buying expensive coffee, and spending on avocado and toast, it isn’t just the day-to-day expenses that can throw off your financial goals.

Before making big purchases such as on a home or a car, you will want to look at how much loan you would have to take, and if it is something you can service comfortably.

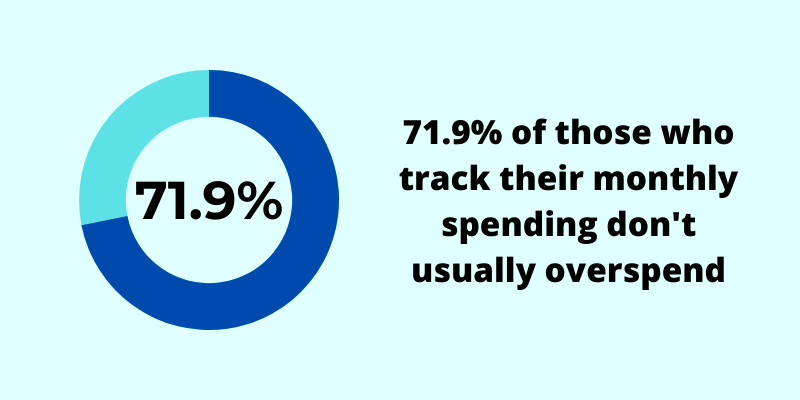

We have also found that Singaporeans who keep track of their day-to-day expenses are usually able to save more.

You can either keep track of this using an Excel sheet, or download one of the many apps available online to input your spending. This will help you to keep to your budget.

4) Invest More

Last but not least, invest. Inflation is a painful fact of life. Without investing, your hard-earned money will devalue over time. If you are completely new to investing, you will first need to assess your risk appetite. Investing always carries a risk of you losing, just as it carries a high possibility of you compounding your money.

You can always start small by investing in the Singapore Savings Bonds or go into stocks and shares. If you are completely lost, it is worth getting a financial advisor to help you on this.

If you would like to optimise your finances and to increase your net worth, why not go through a comprehensive financial plannning? Click here to learn more.