When the first Singapore Savings Bonds (SSBs) were introduced, the demand was high as there were very few safe investment options which provide high potential returns.

Over time, the returns of SSBs have gone down. Is it still a viable option now?

In this article, we’ll take a deeper look at what the SSB is all about, the current and historical interest rates, and the pros and cons.

So, read on!

But First, What Are Bonds?

A bond is typically issued by a company or government. When an investor purchases a bond, they are essentially loaning funds to the issuer. As a reward, bond issuers typically pay investors regular coupons at a predetermined interest rate or fixed sum. At the end of the bond’s maturity date, the issuer will also return the original principal to the investor. The investor thus earns from the accumulated interest payments given by the bond issuer before maturity.

There are various types of bonds you can choose to invest in. One of the key types of bonds you should know about are Singapore Savings Bonds (SSBs).

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What Are Singapore Savings Bonds (SSBs)?

Singapore Savings Bonds were introduced on 1 October 2015 by the Singapore government to provide retail investors with a secure long-term investment option. SSBs are issued under the Monetary Authority of Singapore (MAS), which is under the authority of the Singapore government. This grants the SSBs great credibility, as the government has an incredible credit rating of AAA.

Apart from SSBs, the other main types of Singapore Government Securities (SGS) devised for this purpose are Singapore Government Security (SGS) Bonds and Treasury Bills (T-Bills).

Although SGS bonds and SSBs may seem similar, they have a few key differences.

First and foremost, SGS bonds have a wider range in tenor, varying from two to 30 years, whereas SSBs typically mature in 10 years. Secondly, SGS bonds allow for larger investments as there is no maximum investment amount. Last but not least, SGS bonds are less flexible compared to SSBs. While SSBs can be redeemed anytime even before maturity with no penalty, SGS bonds need to be sold in the secondary market if investors want to exit early. For the retail investor, SSBs are more accessible.

How Exactly Does a Singapore Savings Bond (SSB) Work?

Now that you understand the brief overview of SSBs and SGS bonds, let’s dive deeper into the mechanics of how SSBs work.

SSBs are considered long-term investment options. The coupon rates have a “step-up” feature which allows investors to reap more attractive return rates when the bonds are held over a longer period of time.

Another key feature is that SSB interest rates are linked to SGS yields. The initial interest rate of an SSB is based on the average SGS yield from the month before applications for that particular SSB issue. The average compounded returns of an SSB are meant to match the effective yield of a corresponding SGS held over the same period of time.

The key exceptions to this matching principle are:

- Differences due to small rounding variations of up to +/- 0.03% that may arise when computing average returns

- If the SGS yield does not allow interest rates to step up, the SSB is designed to prioritise the “step-up” feature over its correspondence with the SGS yields for a given year. In no occasion will the interest rate remain stagnant or “step-down”.

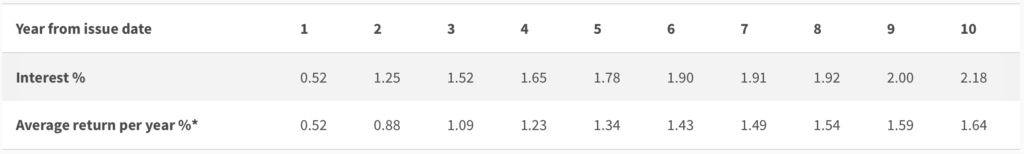

Let’s just look at a simple illustration of February 2022’s issue:

For example, if you were to apply for an SSB with an original principal of $1,000 in February 2022, you may get a return of $5.20 (0.52%) in your first year. In the second year, you may get a higher interest of $12.50, which is 1.25% of your original principal. Taken together, your average compound interest rate is 0.88% over the period of the first two years.

This “step-up” principle continues until the 10th year, which is the typical period of maturity for SSBs. Typically, the interests paid out in the later years are the highest. The effective return you get over the period of 10 years may be averaged to 1.64% per year, for example.

Illustration: How Much Returns Can You Get from Singapore Savings Bonds (SSB)

The easiest way to calculate your projected returns from investing in an SSB is to use the MAS calculator.

Suppose you invested $20,000 into the SSB for February 2022 and held the bond for all 10 years up to maturity, you would earn an effective return rate of 1.64% as promised. The estimated returns amount to $3,325 at the end of 10 years.

Alternatively, if you decide to redeem your bond ahead of time in five years, your effective return rate would be 1.34%, amounting to $1,343.43 in earnings.

As you can see, it is typically more beneficial to hold your SSBs for as long as possible, ideally all the way till maturity to reap the highest returns.

What’s the Interest Rate of This Month’s Singapore Savings Bond (SSB)?

For the issue in the month of February 2022, the average return per year is 1.64%, if held over 10 years.

| Year from issue date | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Interest % | 0.52 | 1.25 | 1.52 | 1.65 | 1.78 | 1.90 | 1.91 | 1.92 | 2.00 | 2.18 |

| Average return per year % | 0.52 | 0.88 | 1.09 | 1.23 | 1.34 | 1.43 | 1.49 | 1.54 | 1.59 | 1.64 |

This interest rate is considerably lower than that of earlier years. In comparison to this month’s estimated yield, the SSB issued in September 2018 had a projected yield of 2.44% when held for 10 years.

This significant dip is likely due to poor market conditions caused by the ongoing COVID-19 pandemic.

Singapore Savings Bonds (SSB) Interest Rates: Trends and Historical Rates

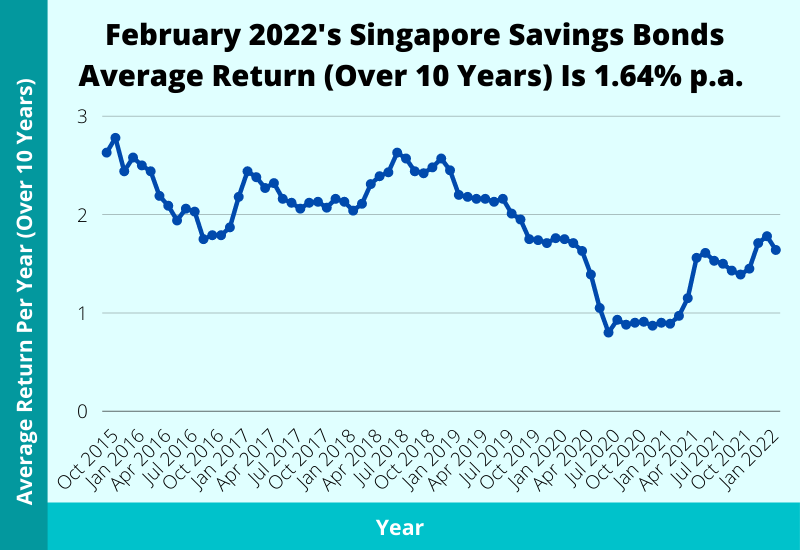

There were high hopes for the SSB as a secure and easily accessible investing instrument for Singaporeans. However, the historical trend of the SSB’s interest rates have shown a steady decline, even before the occurrence of the COVID-19 pandemic.

Here are the historical yields of the Singapore Savings Bonds (SSBs):

| Oct 2015 | Nov 2015 | Dec 2015 | Jan 2016 | Feb 2016 | Mar 2016 | Apr 2016 | May 2016 | Jun 2016 | Jul 2016 | Aug 2016 | Sep 2016 | Oct 2016 | Nov 2016 | Dec 2016 | Jan 2017 | Feb 2017 | Mar 2017 | Apr 2017 | May 2017 | Jun 2017 | Jul 2017 | Aug 2017 | Sep 2017 | Oct 2017 | Nov 2017 | Dec 2017 | Jan 2018 | Feb 2018 | Mar 2018 | Apr 2018 | May 2018 | Jun 2018 | Jul 2018 | Aug 2018 | Sep 2018 | Oct 2018 | Nov 2018 | Dec 2018 | Jan 2019 | Feb 2019 | Mar 2019 | Apr 2019 | May 2019 | Jun 2019 | Jul 2019 | Aug 2019 | Sep 2019 | Oct 2019 | Nov 2019 | Dec 2019 | Jan 2020 | Feb 2020 | Mar 2020 | Apr 2020 | May 2020 | Jun 2020 | Jul 2020 | Aug 2020 | Sep 2020 | Oct 2020 | Nov 2020 | Dec 2020 | Jan 2021 | Feb 2021 | Mar 2021 | Apr 2021 | May 2021 | Jun 2021 | Jul 2021 | Aug 2021 | Sep 2021 | Oct 2021 | Nov 2021 | Dec 2021 | Jan 2022 | Feb 2022 | |

| Average interest rate p.a. (%) over 10 years | 2.63 | 2.78 | 2.44 | 2.58 | 2.50 | 2.44 | 2.19 | 2.09 | 1.94 | 2.06 | 2.03 | 1.75 | 1.79 | 1.79 | 1.87 | 2.18 | 2.44 | 2.38 | 2.27 | 2.32 | 2.16 | 2.12 | 2.06 | 2.12 | 2.13 | 2.07 | 2.16 | 2.13 | 2.04 | 2.11 | 2.31 | 2.39 | 2.43 | 2.63 | 2.57 | 2.44 | 2.42 | 2.48 | 2.57 | 2.45 | 2.20 | 2.18 | 2.16 | 2.16 | 2.13 | 2.16 | 2.01 | 1.95 | 1.75 | 1.74 | 1.71 | 1.76 | 1.75 | 1.71 | 1.63 | 1.39 | 1.05 | 0.80 | 0.93 | 0.88 | 0.90 | 0.91 | 0.87 | 0.90 | 0.89 | 0.97 | 1.15 | 1.56 | 1.61 | 1.53 | 1.50 | 1.43 | 1.39 | 1.45 | 1.71 | 1.78 | 1.64 |

Overall, the expected effective yield of holding on to an SSB till maturity has dipped from 2.63% in October 2015 to 1.64% in February 2022’s issue.

Singapore Savings Bonds (SSBs) vs Other Alternatives

Apart from Singapore Savings Bonds (SSBs), there are several other long-term investment instruments that you can consider. These include ordinary or high-interest savings accounts, fixed deposits, and endowments.

Fixed deposits are a form of investment that promises guaranteed interest and returned principal. While the concept of fixed deposits is relatively similar to SSBs, there are some key differences. Fixed deposits tend to offer lower average interest rates but also have a shorter tenure compared to SSBs, such as 3 to 36 months, meaning there is a shorter lock-in period. There is also no maximum cap you can invest in fixed deposits.

Meanwhile, high-interest savings accounts are highly liquid and have no lock-in period at all, but generally earn an even lower interest compared to fixed deposits and SSBs. The current interest rates of high yield savings accounts mainly vary from 0.3% to 1%.

Last but not least, endowment plans are fundamentally forced savings plans. They are highly illiquid as withdrawal ahead of time means the investor will not get the promised returns or even their capital.

Compared to these alternatives, SSBs may seem like a safer option as your principal amount is always guaranteed. However, choosing which instrument to invest in will depend on your needs.

How to Buy Singapore Savings Bonds (SSB)

Who Can Buy?

Anyone can buy a Singapore Savings Bond in Singapore, including foreigners and institutions. Individuals have to be aged 18 and above to be eligible.

What Do You Need?

To be eligible, one needs to have an individual Central Depository (CDP) account or SRS account and a bank account with one of the 3 local banks in Singapore – DBS/ POSB, OCBC or UOB.

What Are Your Funding Options?

You can apply with cash using funds from your POSB, OCBC, or UOB bank account. Alternatively, if you are already in the Supplementary Retirement Scheme (SRS), you may also use these funds to invest in SSBs.

How to Apply?

Interest investors may apply via ATM, internet banking, or through their SRS account. For more information, check out the simple instructional videos done by MAS.

Are There Any Charges?

There is a small non-refundable $2 transaction fee for each application.

What’s the Minimum and Maximum Amounts You Can Invest?

The minimum investment amount is $500. Investors may choose to invest $500 or in multiples of $500. The maximum limit is $200,000. Because there is a cap, this means that most people will not be able to depend solely on SSB investments to maximise returns.

How to Redeem Singapore Savings Bonds (SSB)

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

Upon Maturity

SSBs mature after a tenure of 10 years. Upon maturity, your principal and last interest payment will be automatically credited to the relevant bank account where you have been receiving your interest payments. This would be the account linked to either your CDP or SRS account, depending on your initial method of application. No action is needed from your end to redeem the bonds and there will be no transaction fee.

Before Maturity

Investors do have the option of redeeming your SSBs early in any given month. There is no penalty for exiting your investment early, however you will miss out on the higher interest payments towards the later years and thus receive lower effective returns than initially promised.

To redeem your investment, you may go through ATM or internet banking processes if you applied via your bank accounts. For investors who used their SRS funds, you may redeem your bonds through your SRS operator as well.

There is a $2 transaction fee for early redemption requests.

All in all, it is possible but not beneficial to redeem your SSBs early. Taking note of this before you invest and making sure you will not need to touch these funds for the next 10 years would be ideal before going into SSBs.

9 Pros and Cons

Pros

1) Extremely safe and low-risk

Because Singapore Savings Bonds (SSBs) are backed by the government, they are highly secure and can be trusted to deliver on the guaranteed returns. Additionally, they were designed to guarantee principal return as well as certain effective yield using a “step-up” basis, even if the economy and current SGS yields do not allow for it.

2) Relatively higher interests than what banks can offer

SSBs offer significantly higher interests compared to even high-yield savings accounts offered by banks. This means that investing in SSBs can maximise returns and make your money work harder than if you were to simply park it in a bank.

3) Fully redeemable at any time

One of the perks of investing in SSBs is you can redeem your bonds in any given month. You may redeem your bonds partially in multiples of $500, or fully up to the total amount invested in the bond.

4) Act as a diversification

If you have stocks in foreign exchange markets, cryptocurrencies or other high-risk, foreign investments, you may want to have some of your funds invested in SSBs as well to diversify your portfolio and act as a hedge against riskier investments.

5) Returns don’t fluctuate

Unlike most investments, the returns on SSBs do not fluctuate. They predictably follow the “step-up” rule year on year to produce the promised effective returns when averaged out over 10 years. Any minor adjustments will not affect the final effective yield received upon maturity. This is a key benefit that is difficult to find in other instruments.

Cons

6) There are still caps to how much you can invest

There is a maximum cap of $200,000 in any investment. This means that there is a limit to how much you can allocate to this instrument.

7) Higher interest only comes in the last few years

Due to the step-up interest feature, the highest interest rates only come in the last few years. This means that the investment tool is not suitable for investors who want to reap benefits in the short to medium term. Redeeming your bonds early will mean low returns and you would have been better off investing your funds elsewhere.

8) Returns aren’t reinvested

Because interest payments are automatically paid into your bank account each month, they are not being reinvested into the fund. This means that there is a loss on potential compound interest. Additionally, investors will have to look for another instrument to reinvest the earned interest in, which brings reinvestment risk. While you may choose to accumulate these interest payments to purchase more savings bonds, this may not be the wisest option as it will require another 10 years lock-in before maturity.

9) Might not be able to beat inflation

Here are the average inflation rates in Singapore:

| Average Headline Inflation Rate (CPI All-Items) | Average Core Inflation Rate (MAS Core Inflation) | |

| Over the last 10 years (2011 to 2021) | 1.05% | 1.25% |

| Over the last 20 years (2001 to 2021) | 1.54% | 1.49% |

| Over the last 30 years (1991 to 2021) | 1.52% | 1.51% |

Notwithstanding the COVID-19 pandemic situation, the effective interest of SSBs have always been too close to inflation rates for comfort.

The estimated effective yield for October 2018’s SSB was 2.42%, which can be considered as relatively high for the instrument. However, this is less than 1% higher than the average inflation rate of 1.52% we have seen over the past 30 years. Additionally, it should be noted that inflation rates have been rising substantially in previous decades. This suggests that the trend will continue. Thus, SSB investments may not be the best investment tool to help investors beat inflation.

Should You Invest in Singapore Savings Bonds (SSB)?

Are Singapore Savings Bonds worth buying? This depends heavily on your purpose for investing, as well as your current financial portfolio and situation. In general, SSBs can be a good option for diversification in your investing portfolio.

As a low-risk security, SSBs are a safe option for beginning investors or investors who are already vested in other higher-risk stocks and equity who wish to diversify their portfolio.

However, it is strongly recommended that you should only invest in SSBs if you have spare funds that you will not require for the next 10 years. This is because investing in SSBs is only worth it if you invest in them till maturity, although you can easily redeem them early.

At the end of the day, however, SSBs will not offer you high interest rates. If you are looking to earn higher interest, you may wish to consider other alternatives to better maximise your money.