ElderShield has been the talk of the town for awhile now.

Why did this scheme go through so much love and hate?

In this article, we cover the important claim statistics and interesting facts on this topic.

It’ll be very enlightening and gives light on why the new scheme CareShield Life is created.

So, read on!

Short Introduction

ElderShield is a long term care insurance scheme that provides a monthly payout for a fixed amount of time, when a severe disability happens.

It’s different from MediShield Life and the Integrated Shield Plan as they are medical insurance that provide the ability to claim from huge medical bills.

As long as you’re a Singapore Citizen or Permanent Resident, you’ll be automatically enrolled into ElderShield once you reach the age of 40 (for those born in 1979 or earlier).

This will not be the same for those born in 1980 or later as they will be under the new CareShield Life scheme. However, those who are on ElderShield can still switch to CareShield Life. If you want to know more, learn more about the differences between ElderShield and CareShield Life.

The ElderShield scheme is initiated by the Ministry of Health in 2002 but administered by three insurance companies:

- Singlife with Aviva

- Great Eastern

- NTUC Income

Premiums for this severe disability insurance can be paid using your CPF MediSave balance.

Let’s look at the statistics of ElderShield claims.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

1) Out of 1.3 million Singaporeans covered under ElderShield, only 15,600 policyholders had claimed

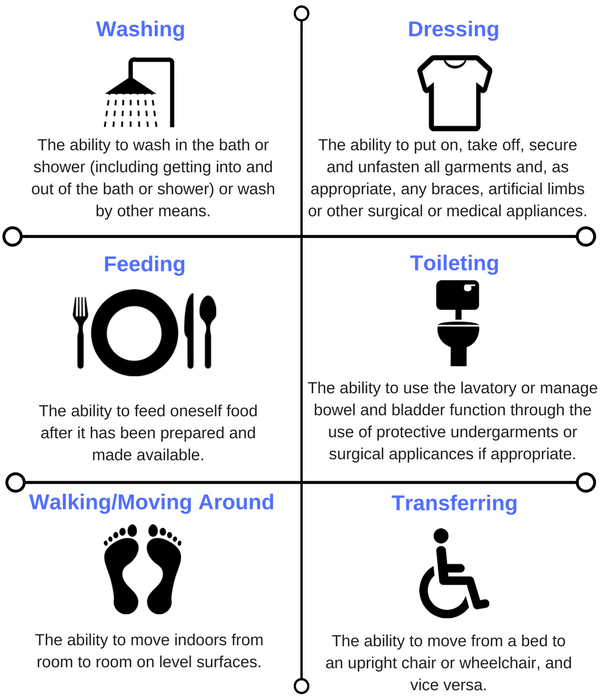

To claim from ElderShield, you need to be unable to perform at least 3 out of 6 Activities of Daily Living.

These are the 6 ADLs:

- Washing

- Dressing

- Feeding

- Toileting

- Transferring

- Mobility

Although full data is not readily available, there is one review report that gives us some light on this section.

As of 2017, there were 1.3 million Singaporeans covered under ElderShield.

Out of which, only 15,600 had claimed since 2002. And only 6,300 policy owners are still actively claiming (if one were to recover, payouts stop).

In a very crude way to calculate the claim rate, we take claims made/total population covered.

Claim Rate: 1.2% (15,600/1,300,000*100)

This figure seems low but it doesn’t tell the full story.

More on that later.

2) ElderShield premiums amounting to $3.3 billion were collected

At the end of 2017, a total of $3.3 billion in premiums were collected.

This amount seems excessively high when we compare the amount of claims being disbursed.

And this was one of the reasons why there were a lot of chatter surrounding ElderShield.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

3) Only $133 million were paid out in ElderShield claims

Out of the $3.3 billion collected, only $133 million were paid out in claims.

Mathematically, the claims paid out account for only 4.03% of all premiums collected.

And this made some people question the scheme.

4) The median age of policy owners is 52 years old; the median age at which claims were made is 67 years old

Nobody likes to be taken advantage of.

Upon first look, it seems that the ElderShield scheme is extracting more of Singaporeans’ resources rather than benefitting them.

However, I think greater emphasis should be made on why the figures are as such.

The reason is because of pre-funding.

How does it work?

The probability of a severe disability is much lower when you’re younger compared to when you’re older.

So the premiums you’re forking out right now are usually meant to be paid out when you’re older.

This is reinforced by the fact that ElderShield premiums stop at age 65 but the coverage is for life.

It’s basically to “save for a rainy day”.

This scenario is also reflected in the reports:

Median age of policy owners: 52 years old

Median age which claims were made: 67 years old

So a majority of policyholders have yet to reach that age for claims.

And therefore, the current “claim rate” does not reflect the true picture and claim payouts will be much higher in years to come.

5) The Government will take over the ElderShield portfolio

In 2021, the government will take over administration of ElderShield from the private insurers.

This is a significant move.

They will administer the scheme on a not-for-profit basis.

For example, if the future claim experience turns out better than expected, there can be premium rebates for the ElderShield policyholders.

As for those who are currently on ElderShield and wish to upgrade to CareShield Life, you’re able to do so in 2021, provided you’re not already severely disabled.

Conclusion

While there are ups and downs with the existing ElderShield scheme, I believe the government has done a good job.

Why?

They conducted a serious review on its existing framework and came out with the new CareShield Life scheme.

They learnt from past experiences so as to benefit the future cohorts.

The government will also not be profiting from CareShield Life. Any surpluses will stay within the fund and not be transferred to other government schemes. Examples of how this will benefit policy owners are premium rebates and higher payouts.

Learn more about CareShield Life or the differences between CareShield Life and ElderShield.