Critical illnesses (CIs), whether they’re in the early, intermediate, or late stages, can be devastating, not just on your health, but on your finances too.

We can reduce the chances of getting a critical illness by practicing healthy habits. Likewise, having insurance coverage will reduce the chances of a financial disaster if a CI strikes.

In this guide, you’ll learn everything about critical illness insurance plans in Singapore, including what it is, why it’s important, how much you should be covered, and the different types of CI coverages out there.

So, read on!

This page is part of the Early Critical Illness Insurance 2-Part Series:

- Part 1: Guide to Critical Illness (and Early Critical Illness) Insurance

- Part 2: Finding the Best Early Critical Illness Insurance

- What Is a Critical Illness or Early Critical Illness?

- What Is Critical Illness Insurance (And How Does It Work)?

- 5 Reasons Why You May Need Critical Illness Insurance

- How Much Critical Illness Cover Do You Need?

- What Types of Critical Illness Insurance Coverages Are There?

- 5 Key Considerations for Early Critical Illness Insurance

- What's Next?

What Is a Critical Illness or Early Critical Illness?

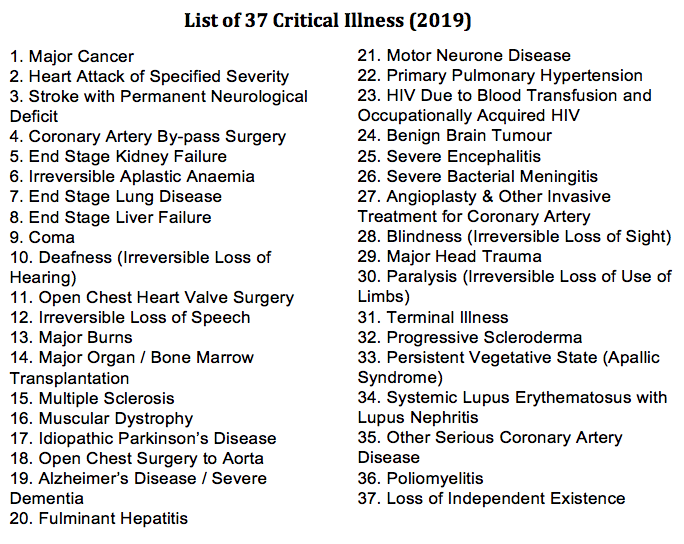

The Life Insurance Association (LIA) in Singapore has standard definitions for 37 critical illnesses (CIs).

Here’s the list of the 37 critical illnesses:

These illnesses are typically in the severe (advanced/late) stages. Their definitions are standardised across all insurance companies.

These definitions go through several revisions periodically to provide greater transparency and clarity for consumers. These revisions also provide additional reassurances that if you make a claim from one company, a claim from another company shouldn’t be rejected as the definitions are the same.

On the other hand, an early critical illness, or Early CI/ECI, generally refers to the early and/or intermediate stages of a CI.

Although there are standardised definitions for the CIs (advanced stage), there are none with early critical illnesses. In other words, definitions for ECIs may differ between insurance companies.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What Is Critical Illness Insurance (And How Does It Work)?

A critical illness insurance is an insurance policy that pays out a lump sum of money if an insured event happens.

Depending on the policy, that insured event could be a critical illness in the early, intermediate, or late stage, or could be other specified illnesses.

The CI coverage could come in the form of a standalone plan or as a rider attached to a life insurance policy (e.g., term insurance and whole life insurance).

More on the different types of plans and coverages later in the article.

5 Reasons Why You May Need Critical Illness Insurance

Is critical illness insurance necessary in Singapore? Is it worth having it?

While CI coverage comes with a higher price tag, here are some reasons why it could be beneficial:

1) The probability of getting a critical illness can be high

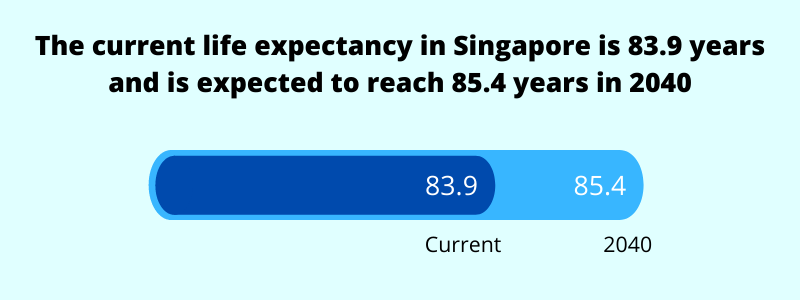

While Singaporeans now enjoy a longer life expectancy of 83.9 years, we spend longer time in ill health (10.6 years, in fact).

Now, more than ever, there are higher incidences of chronic diseases, such as high blood pressure, high cholesterol, diabetes, etc. However, when compared to critical illnesses, they’re less severe.

I’ve written a more in-depth article on various critical illness statistics in Singapore, but here’s a short summary.

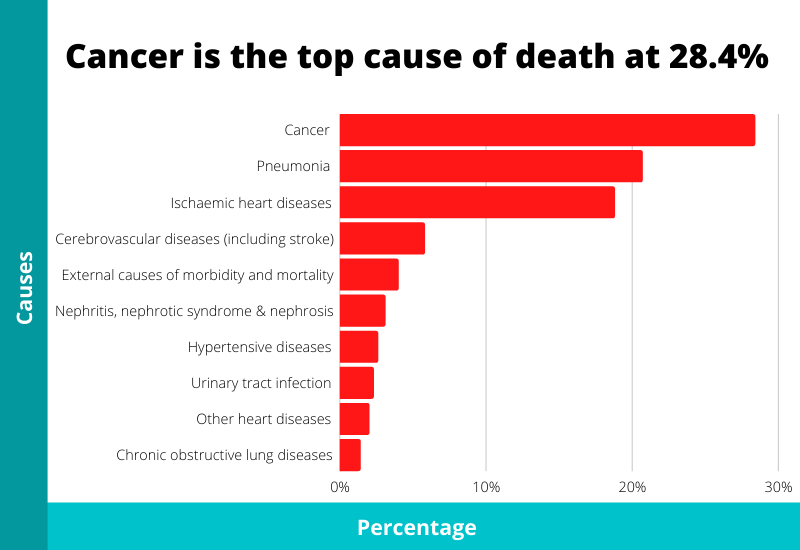

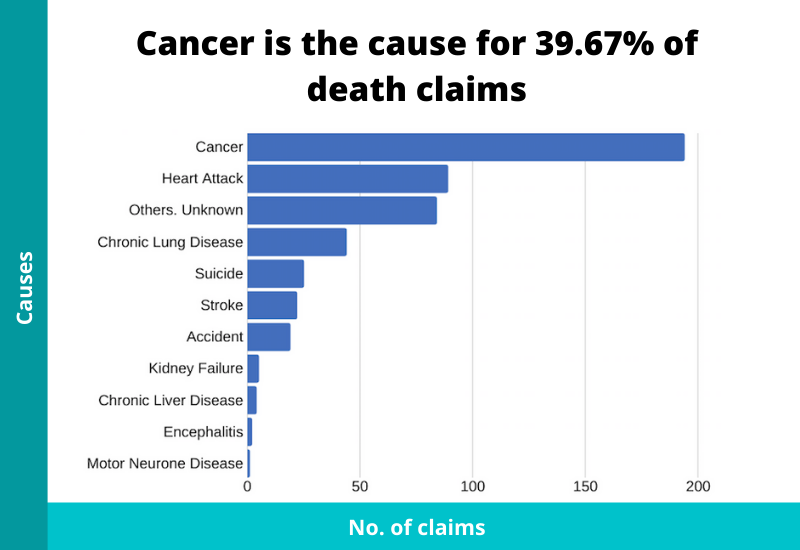

Illnesses, especially cancer, are the cause for a huge percentage of deaths in Singapore.

Cancer is the most common critical illness and one in every four to five Singaporeans may get cancer before age 75.

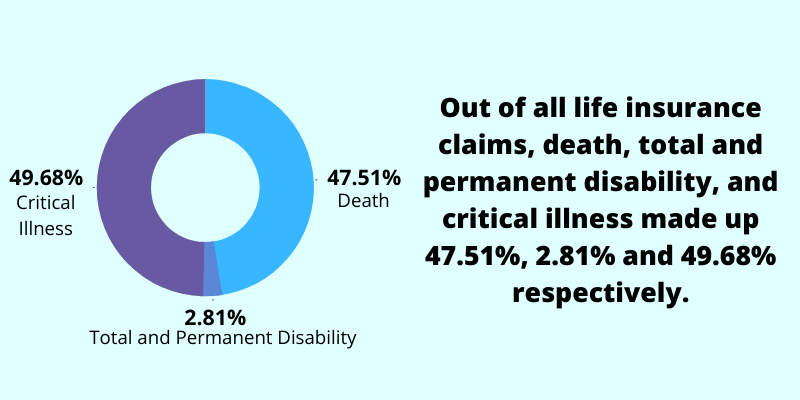

We also analysed 36 months of life insurance claims statistics in Singapore. Not only does cancer account for the most death claims..

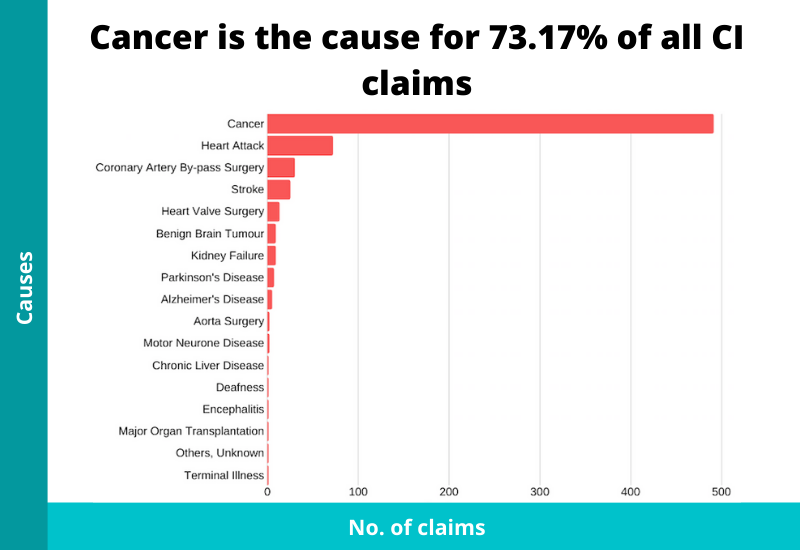

It also accounted for the highest number of critical illness claims by a huge margin.

So topics on critical illness almost always include cancer.

2) The cost of treating a CI is significant

Contracting a critical illness is not just a health concern, but a financial one too.

With medical costs increasing every year, you can expect the average hospital bill size to balloon over time.

Cancer treatments usually include a combination of surgeries, radiotherapy, and chemotherapy, and the cost for treating late-stage cancer can amount to $100,000 to $200,000 yearly.

Are we able to pay for the cost of treatment if we become unlucky?

3) There may be limitations with the coverage from hospital plans

If you’re a Singapore citizen or a permanent resident, you will be covered under the national health insurance, MediShield Life. In addition, most people would’ve upgraded their basic plan to an Integrated Shield Plan.

This combination will give you the best medical insurance coverage, and it still remains to be one of the most fundamental components in a good insurance portfolio.

If a critical illness happens, and you need to be hospitalised or a surgery is needed to be done, those bills can be eligible for claims.

However, restrictions may still apply. For example, alternative treatments are likely not to be covered.

4) Having only the basic life insurance coverage might be inadequate

Basic life insurance coverage, in this case, refers to payouts if death or total and permanent disability (TPD) happens.

Although having such coverage (and adequate amounts) is a good start, it may not be comprehensive due to the higher possibility of getting hit by a CI.

5) A CI can reduce the ability to work and earn an income

While eligible medical costs at the hospital can be covered by your hospitalisation plan, you may find yourself in a situation where you’re unable to work and earn an income when you return home.

However, other bills and financial commitments need to go on.

How are you going to find the money for that?

If you have ready cash and assets that have already been ear-marked and are meant for such situations, great. But if you don’t, that money has to come from somewhere.

CI plans will be able to provide you with that money to last through your recovery period.

How Much Critical Illness Cover Do You Need?

A lot has been said about the prevalence and the implications of a critical illness.

However, what have Singaporeans done to address that?

A study was done in 2017 by the Life Insurance Association (LIA). In its lengthy 87 page report, it was stated that the average working adult in Singapore only has $59,776 of CI coverage.

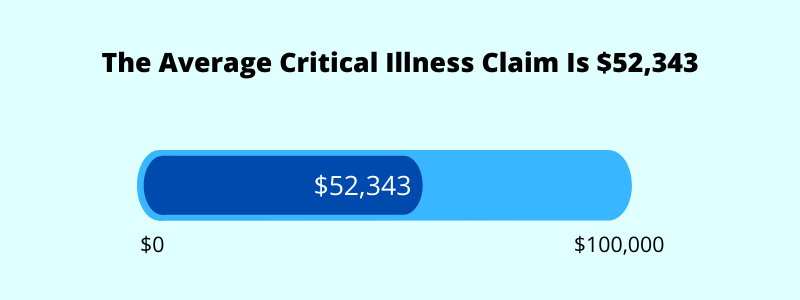

This is very close to the average CI claim of $52,343.37 in a study we did on life insurance claims.

Think for yourself: would this amount be enough? Probably not, and this is why most people are under-insured.

But, how much does one need?

In the LIA’s study, adults are recommended to have enough CI coverage to last for a recovery period of five years. On average, that amounts to $316,603. Subtracting the previous existing CI coverage from this amount, we’ll get the total gap in CI coverage which is $256,826 ($316,603-$59,776).

That’s for the standard CI, but if you want to cover for early critical illness, covering that amount will be expensive. In my opinion, I’m happy to be able to cover for one to two years of recovery period if an ECI happens. You might not need so much because early CIs take lesser time to treat, cost less, and survivability is higher.

Can you go crazy and get all the CI cover you want? No, there’s an industry cap on the amount of CI cover you can get. Generally, it’s at $3,000,000. You probably don’t need that much and it can get really expensive. For ECI cover, each company has their own caps, usually around $250,000.

Now, those figures are just general guidelines, and the needs of everyone are different.

(Feel free to play around with our CI coverage calculator.)

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

What Types of Critical Illness Insurance Coverages Are There?

If you wish to beef up on your critical illness cover, what are your options?

Here are two options:

- Critical illness rider attached to a life insurance policy

- Critical illness standalone plan

1) Critical illness rider attached to a life insurance policy

There are two popular life insurance policies: term insurance and whole life insurance.

Critical illness (including ECI) coverage can be attached as a rider to these policies. It typically accelerates the death benefit (meaning, if CI happens, the death benefit will be reduced by the CI payout amount). The riders of those policies usually only pay out once.

If you’re lacking in life insurance coverage (e.g., death and total and permanent disability cover), those two plans could be something for you to explore as they’re more holistic.

2) Critical illness standalone plan

The CI standalone plans have low death benefit cover as the purpose is to cater for critical illnesses.

However, there are many variations out there and they’re not easily comparable.

One type is the multipay CI plan. It pays out a lump sum if an early, intermediate, or late stage illness occurs. A unique feature is that multiple claims can be made. And if late-stage CI happens, the plan can pay out a multiple of the basic sum assured. Although those multipay plans come with a heavier price tag, they are the most comprehensive CI plans out there.

Get a comparison of the best early critical illness insurance in Singapore.

5 Key Considerations for Early Critical Illness Insurance

Here are some questions you should be asking yourself if you wish to get coverage for early critical illness:

1) Are you already going for regular screenings?

In most cases, if symptoms show, it might already be too late. Therefore, it’s always a good practice to go for regular screenings.

Regular screenings lead to higher chances of discovering critical illnesses in the early stages. And if you’re able to claim for it and treat it early, chances of recovery and survivability will be higher.

In addition, these screenings can identify less severe conditions like high blood pressure or high cholesterol, which will affect your chances of getting approved for insurance. So, if you’re healthy, do make sure you get covered first.

2) Are you concerned with recurrences?

A survey done by AIA in 2016 indicated that nine out of 10 Singaporeans find it difficult to get another critical illness plan after getting diagnosed with critical illness.

This is very true as insurance companies will require comprehensive documentation and reports from the doctor, and quite often, that illness will be excluded or the application rejected.

And that’s when early CI plans come into the picture. They may allow multiple claims (subject to terms and conditions) which will be very useful.

3) Are you already insured with the basic coverage?

Apart from medical insurance (which you should already have), do you already have the three main coverage: death, TPD, and standard CI?

Because those three can cripple the ability to work, they should be prioritised first, before you consider early critical illness cover. Early CI is usually seen as a bonus.

4) What’s your budget?

The premiums for early CI is one of the most expensive forms of life insurance (because of a higher chance of claiming).

But, if you do have the excess budget, feel free to check it out.

5) How’s your family medical history looking?

Although less common, certain illnesses, such as heart diseases and cancer, can be hereditary.

If you’re aware of your family members or relatives having such illnesses, there could be an increased chance that you could inherit them. So, it would be good if you get covered early.

What’s Next?

To summarise everything:

The implications of a critical illness are not just emotional and physical, but can be financial as well.

While the emotional and physical pains stay, the financial pains can be prevented.

With critical illness and early critical illness insurance, you can have a greater peace of mind that if a dread disease were to occur, your finances can still be taken care of.

If you have the budget, and having a standalone critical illness plan makes sense to you, take the first step and compare the best early critical illness insurance plans in Singapore.