Contemplating using TransferWise (now known as Wise) for online/international money transfers to send and receive money?

Well, you’ve come to the right place.

With TransferWise, your money denominated in your local currency can be automatically converted and sent to foreign bank accounts, and vice versa.

I’ve personally sent and received funds using their services.

Here’s my review of TransferWise, from the perspective of a person who’s located in Singapore (though it doesn’t really matter which country you’re from).

Summary: Using TransferWise was a breeze. It took me 5 minutes to set up a transfer, get verified, and transfer the funds. It took TransferWise an additional 11 minutes to send out the funds to an overseas bank account. Furthermore, the fees were extremely low.

- What It Was Like to Send and Receive Money Back in the Day

- What Is TransferWise?

- How Does TransferWise Work?

- Are TransferWise Fees, Charges, and Exchange Rates Cheap?

- Is TransferWise Safe and Legit (or Should You be Worried)?

- Who Is TransferWise For?

- My Personal Experience with TransferWise in Singapore

- Quick Guide: How to Send Money Using TransferWise

- 7 Pros and Cons of Using TransferWise

- Final Thoughts

What It Was Like to Send and Receive Money Back in the Day

I’ve done a fair share of international money transfers over the years.

Some of these transfers include:

- Using Western Union to send money to China (without escrow) for goods

- Receiving and sending money using Payoneer

- Receiving funds from the UK for a payment

- Funding and receiving countless payments to PayPal and withdrawing the balances back to my local bank account

Collectively, these traditional methods of online money transfers come with three pain points:

- Setting up and initiating a transfer was very tedious

- The platforms took an excessively long time to send out funds

- Fees were awfully high

The third point should be emphasised the most.

Not only was there potentially a minimum fee (so it didn’t make sense to transfer small amounts), it was also possible that the fees charged were a high percentage of the transfer amount. And to top it all off, the foreign currency conversion was usually marked up. So, even for platforms that charge $0 in fees, they may be charging more with higher conversion “fees”.

In the end, after the transfer, the receiver sees a much lower amount.

Have you faced the same issues?

To be fair, such platforms were the only few options back then, so I didn’t think too much into it. However, these fees weren’t always conveyed in a transparent way in the first place.

Times have changed, though.

I only realised how costly and time consuming these money transfers were when I was introduced to a new alternative, and that’s TransferWise.

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

What Is TransferWise?

Wise (previously known as TransferWise) is primarily known for online money transfers, with a company mission of “helping people manage their money internationally more cheaply, quickly, and transparently.”

The company was launched in 2011, and it has an interesting story of how it all started.

The two co-founders, Taavet and Kristo, are both from Estonia but moved to London. Taavet got paid in euros. Kristo got paid in pounds, but he had to pay his mortgage in euros. Because they had to use their banks to move money, they incurred high costs with poor exchange rates. That’s how they got together and came up with a simple workaround.

The solution: both just needed to look up the real exchange rates, and Taavet simply had to transfer euros into Kristo’s Estonian bank account, while Kristo transferred his pounds into Taavet’s UK account. That was it. The transfers were almost instant, and there were no extra costs or bad exchange rates.

This workaround is how TransferWise works to this day for users around the globe.

As the company grew to more than just money transfers, it was rebranded to Wise in March 2021 to reflect a broader range of offerings, such as a multi-currency account, a debit card that can be used internationally, an account meant for business purposes, and the ability to transfer large amounts.

How Does TransferWise Work?

If you’ve read the above story, you’ll know how TransferWise started – as just a simple workaround.

As countries around the world have different financial regulations, things aren’t so simple (on the backend) as opposed to having just two individual users, but the core concept of how it all works remains the same.

Here’s a very basic explanation.

TransferWise has multiple bank accounts across the world, and they’re linked together by smart technology. Users are able to send money to 80 countries.

Some of the countries in which TransferWise operates include:

- Singapore

- Malaysia

- Hong Kong

- India

- Indonesia

- Philippines

- United Kingdom

- Australia

- United States

To see the full list of countries, click here.

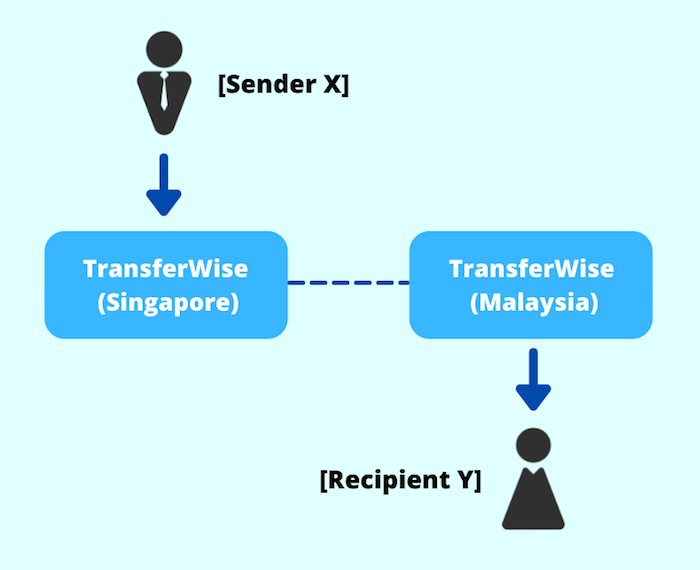

Let’s take a look at an example of how TransferWise works:

[Sender X] earns an income in Singapore dollars, which is directly credited into his SGD bank account. However, he wishes to remit this money to [Recipient Y], who holds an MYR bank account back in Malaysia.

[Sender X] simply transfers his SGD to TransferWise (Singapore)’s account.

TransferWise (Singapore) then acknowledges the receipt of funds, and informs TransferWise (Malaysia) to make a transfer.

TransferWise (Malaysia) then transfers MYR to [Recipient Y].

The end. It sounds like there are a lot of steps, but I’m just spelling out the details.

The “transferred” money doesn’t cross any borders, so there are no other middlemen charges except from TransferWise itself. I’ll talk about this in the next section.

So from TransferWise’s perspective, it’s like “transferring from the left hand to the right hand”. But because it operates in many countries, it doesn’t just have two hands.

Here’s a video of how it works:

Are TransferWise Fees, Charges, and Exchange Rates Cheap?

Traditionally, international money transfers are routed from point A to B to C to D, etc. This process incurs multiple middlemen fees, leading to recipients receiving much less (or the sender having to pay more). TransferWise is able to eliminate this painful process.

Furthermore, financial institutions such as banks or money exchange/transfer services may claim to have $0 fees, but are likely to include a profit margin on top of the mid-market exchange rate.

This mid-market exchange rate, also sometimes called the interbank rate, spot rate, or the real exchange rate, is usually what financial institutions use to swap currencies with each other. It’s rarely quoted and given to consumers.

Below, I touch on three components of fees for sending money with TransferWise:

- Foreign exchange rates

- Funding fees

- TransferWise fees

1) Foreign Exchange Rates

So, what rate does TransferWise use?

The foreign exchange rate that TransferWise uses is the mid-market exchange rate, which is typically the rate you see when you Google, for example, “1 USD to SGD”.

Organisations determine this rate using different models; however, they don’t vary too much. TransferWise pulls this rate from Reuters, which is updated real-time.

So exchange rates-wise, you’re getting the real deal.

Note: when you initiate a transfer, the exchange rate that’s quoted to you will be the rate used for conversion, but it’s only guaranteed for a period of time. You’ll have to make a transfer to TransferWise within that specified timeframe. For example, the rate is locked for 96 hours (subject to changes) when you use SGD to send to a GBP account. If you’re unable to send in time, the funds will still be converted, but at the prevailing mid-market rate.

As rates fluctuate all the time, see what kind of exchange rates TransferWise can give you now. You can even get notifications when rates hit a specified level or receive daily alerts.

While the mid-market rates TransferWise uses are a huge plus, it’s unrealistic to not pay any fees on money transfers.

2) Funding Fees

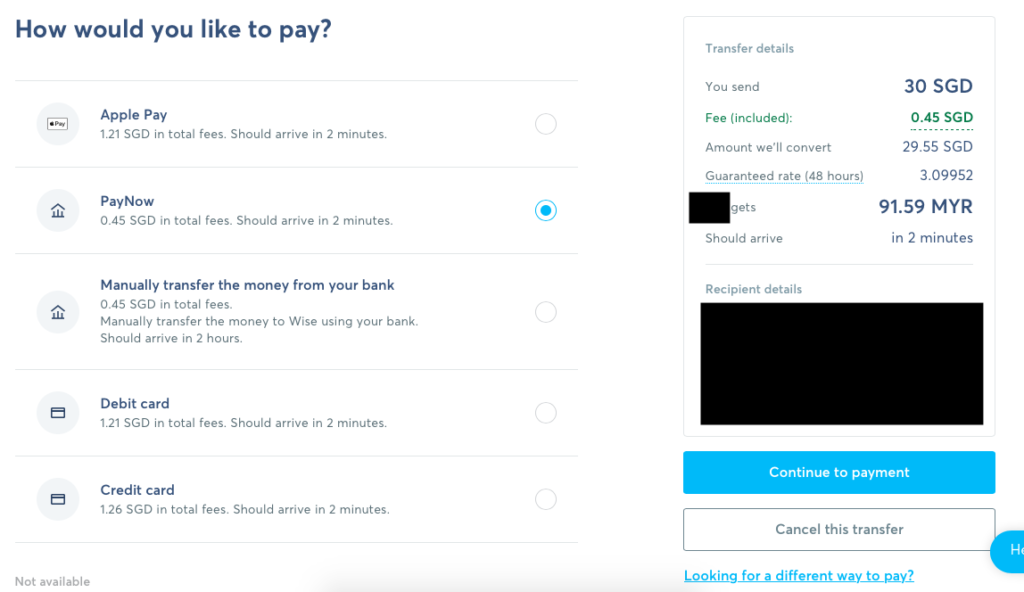

In the context of Singapore, here are TransferWise’s payment methods (as of 17 Sep 2021):

| Funding Fees | Approximate Time for Funds to Reach TransferWise | |

| Bank Transfer | None | Two hours |

| PayNow (Highly Recommended) | None | Two minutes |

| Debit Card | ~2.6% of transfer amount | Two minutes |

| Credit Card | ~2.7% of transfer amount | Two minutes |

| Apple Pay | ~2.6% of transfer amount | Two minutes |

As you can see, one of the best ways to fund the account is by using PayNow, which is also what I use. It doesn’t incur any funding fees, and it’s almost instant.

So, whenever possible, use PayNow or bank transfers, since they incur $0 in fees.

3) TransferWise Fees

There’s no free lunch in the world. While TransferWise can give you mid-market exchange rates, this is the only area that can benefit them.

TransferWise’s service fees include a small fixed fee and a low variable fee, which is a percentage of the transfer amount.

These fees will differ depending on the currency you’re using to convert and where you’re sending it to.

Here’s an example of how much TransferWise charges for sending money from SGD to MYR (as of 17 Sep 2021):

| 1 SGD | 100 SGD | 1,000 SGD | 10,000 SGD | |

| Fixed Fee | 0.29 SGD | 0.29 SGD | 0.29 SGD | 0.29 SGD |

| Variable Fee (0.53%) | 0 SGD | 0.53 SGD | 5.27 SGD | 52.72 SGD |

| Total Fees | 0.29 SGD | 0.82 SGD | 5.56 SGD | 53.01 SGD |

If you want to check how much you’ll have to pay, you can use the TransferWise calculator.

To Sum Up the Fees

Again, there are three components of TransferWise’s fees:

- Foreign exchange rates

- Funding fees

- TransferWise fees

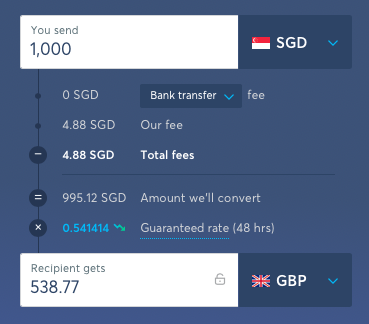

Here’s how it’ll all look:

When you initiate a transfer, you’ll see all the upfront fees, the exchange rate, the amount to fund, and the amount your recipient will receive. (I’ll show the details of my transfer later.) The exception is when you’re unable to fund the transfer on time.

TransferWise claims to be six times cheaper than traditional banks or PayPal. The only way to find out how much you’ll have to pay in fees and the exchange rate you can get is to play with their simple-to-use calculator. It’ll give you instant details without the need to register an account.

Other Examples of Fees

Here are the fees (using a bank transfer/PayNow) for transferring 1,000 SGD to various countries (as of 17 September 2021):

| Total Fees | How Much Recipient Receives | |

| Malaysia | 5.56 SGD | 3,081.39 MYR |

| Hong Kong | 5.63 SGD | 5,750.91 HKD |

| United States | 5 SGD | 739.36 USD |

| United Kingdom | 4.88 SGD | 536.26 GBP |

| Australia | 4.87 SGD | 1,011.58 AUD |

Here’s how much your recipient will receive when you send 1,000 SGD from TransferWise vs other banks (as of 17 September 2021):

| TransferWise | UOB | |

| Malaysia | 3,081.50 MYR | 2,930.69 MYR |

| Hong Kong | 5,751.76 HKD | 5,487.50 HKD |

| United States | 739.31 USD | 707.44 USD |

| United Kingdom | 536.21 GBP | 510.95 GBP |

| Australia | 1,011.58 AUD | 960.65 AUD |

You can see that your recipient receives more from TransferWise. For more details, check out this page.

Overall, the fees that TransferWise charges are relatively insignificant, especially when I’m able to move money with ease all around the world.

Is TransferWise Safe and Legit (or Should You be Worried)?

To answer this question, we’ll have to look at TransferWise’s financial strength, stability, and whether its operations are regulated.

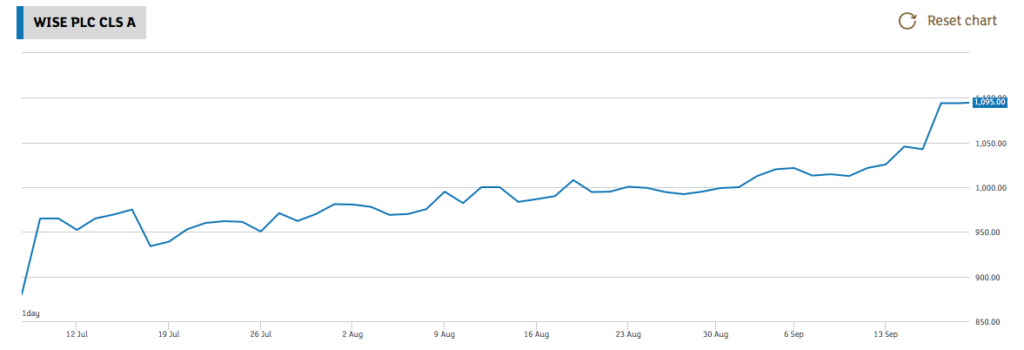

From its humble beginnings, the company has just been listed (“IPO”ed) on 7 Jul 2021 in the London stock market. According to Yahoo Finance, its share price reached a high of £8.8 on its first day of trading. As of 17 Sep 2021, the price of a share hit £11.08, a 25.9% gain in a little over two months, reflecting a total market value of around £10.8 billion.

There are currently more than 10 million individuals and businesses who are using TransferWise’s services. In total, the amount of money that moves through TransferWise is more than £60 billion every year.

TransferWise has 17 offices around the globe, with a total staff count of more than 2,700 employees.

The company also has an office in Singapore. Its current headcount is around 150, and the company plans to add another 70 employees so that it can grow its presence in the Asia-Pacific.

Here are some of the details of its Singapore office:

| Incorporated Name | WISE ASIA-PACIFIC PTE. LTD |

| Address | 1 PAYA LEBAR LINK #13-06 – #13-08 PLQ 2, PAYA LEBAR QUARTER 408533 |

| Contact Number | +65 3165 5681 |

| Website | https://www.wise.com/sg |

For the company to conduct its business around the world, it has to satisfy rules set by regulatory bodies in all the countries it operates in.

So, is TransferWise legal in Singapore?

Yes, its entity in Singapore, WISE ASIA-PACIFIC PTE. LTD, is licensed by the Monetary Authority of Singapore (MAS) as a major payment institution. With such a licence, it must also satisfy requirements to protect its users’ money.

According to MAS, TransferWise is able to provide the following services:

- Account issuance service

- Domestic money transfer service

- Cross-border money transfer service

- E-money issuance service

Being regulated in Singapore also means that would-be users will have to go through verification to prove their identities, which, from my experience, can still be a very simple and fast process.

Furthermore, the platform is integrated with PayNow, which has a user base of about 4.5 million. This enables transactions to take place even more seamlessly.

You can either try TransferWise now or read on further for my experiences.

Who Is TransferWise For?

With Wise’s expanded product lines such as the multi-currency account, international debit card, business account, and being able to transfer large amounts, it’s not just for people who want to send money abroad.

And I’m sure Wise will continue to innovate and build new features to complement what they already have.

Here are some groups of people who will benefit greatly from Wise:

1) Expatriates and foreign workers

Expats and foreigners usually earn a salary in the local currency of their “second home” and no doubt remit some of it back to their families in their home countries.

Having favourable exchange rates and low fees ensures that their family members receive even more money.

Furthermore, with a multi-currency account, users are able to hold certain currencies and use them to pay the bills back at home or anywhere else.

2) Digital nomads and freelancers

The idea of being a digital nomad has always appealed to me. You’re able to travel around the world while still making a sizable income through the internet. This group tends to country-hop regularly and make transactions, online or offline, in multiple currencies.

Freelancers who don’t wish to lead the digital nomad lifestyle also tend to work with people around the world.

This means that not just income, but bills and expenses, come in various currencies. Thus, they’ll all find Wise’s services very appealing.

3) SMEs and businesses

With globalisation and digitalisation, there will be an increase in foreign transactions.

These transactions are derived from employing people overseas for freelance work or on a contract basis, or paying for goods and services in another country.

So, companies big and small will incur more foreign conversion costs and fees, which Wise will be able to help you reduce.

Moreover, business accounts at Wise can integrate with accounting softwares, make bulk payments, and get further discounts on higher transfer amounts.

All these factors will enable you to shift your focus back to your core business, while helping you to reduce costs.

4) People who transact online in another currency

There’s an increasing trend of investing as people are more exposed to investment platforms, wish to invest in global stocks and ETFs, and cryptocurrencies.

It’s quite likely that you’ll need foreign currencies to trade in global markets.

For example, if you wish to invest in US stocks, you need US dollars to buy them.

Wise’s services enable you to save on conversion costs rather than just rely on the broker or investment platform you’re using.

Another group of people that use foreign currencies is online shoppers who buy things from other countries.

With the Wise card, they can avoid paying high foreign exchange conversion costs so that they can save more (or spend more).

5) Frequent travellers

While travelling is still restricted here in Singapore and other parts of the world, countries are likely to open up in time.

When travel resumes, Wise users who go abroad need not carry too much cash. With the Wise card, transactions can be made globally with better exchange rates and lower fees. You’ll also be able to withdraw from ATMs all around the world.

6) International students

Students who choose to study overseas and their parents will find Wise’s suite of products attractive.

Tuition fees, bills, and expenses in the destination country can be all paid with low conversion fees.

The cost of studying overseas is already high. Why not save as much as possible in the process?

My Personal Experience with TransferWise in Singapore

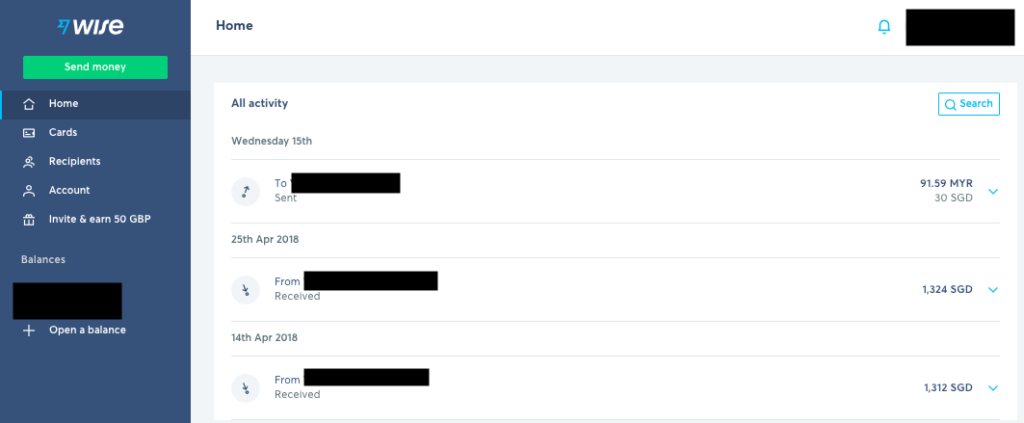

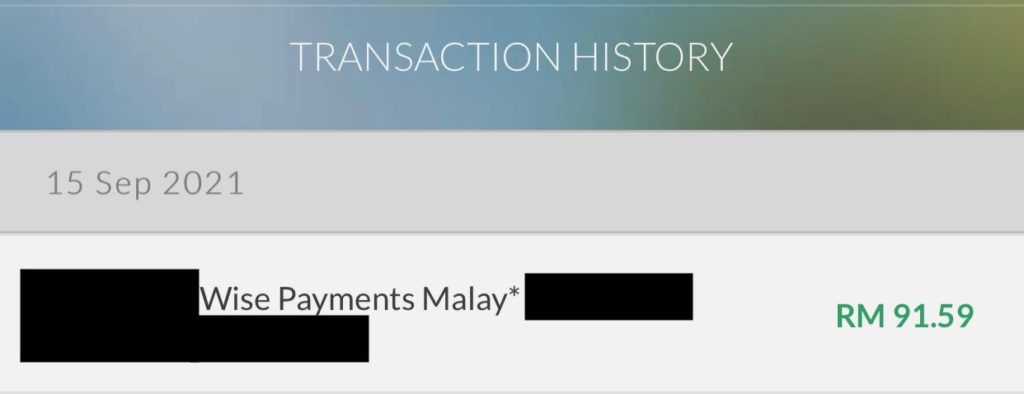

I’ve sent funds from Singapore to another country and have received funds from another country to Singapore.

Here’s a screenshot of my transactions.

And here are my experiences.

Receiving funds via TransferWise

If you’re the recipient of a money transfer, you don’t need to sign up for an account.

Your sender will do all the work.

Here’s the information you’ll need to provide:

- Full name

- Bank name

- Bank account number

And that’s it.

My sender was based in Bali, but used a GBP bank account to send the funds over to my Singapore SGD account.

It took a little over four hours for me to see the money in my bank account. That, to me, is really fast. But your mileage could differ depending on the currencies used and the time of day.

This was significant to me because my original plan was to use PayPal.

If we were to have used PayPal, it would’ve incurred a high amount in fees just for transferring. Furthermore, the withdrawn amount from my PayPal to my local bank account would have gone through an unfavourable foreign exchange conversion and would have incurred even more transaction fees. Not only that, it would have taken a much longer time.

So, in my opinion, this direct route is a game-changer.

Sending funds via TransferWise

You’ll need to register for an account in order to make a money transfer.

My account was already registered before I made this transfer, but it takes just one to three minutes to sign up, along with email and SMS verification.

Here’s a timeline of how I sent money to an MYR account from my SGD account:

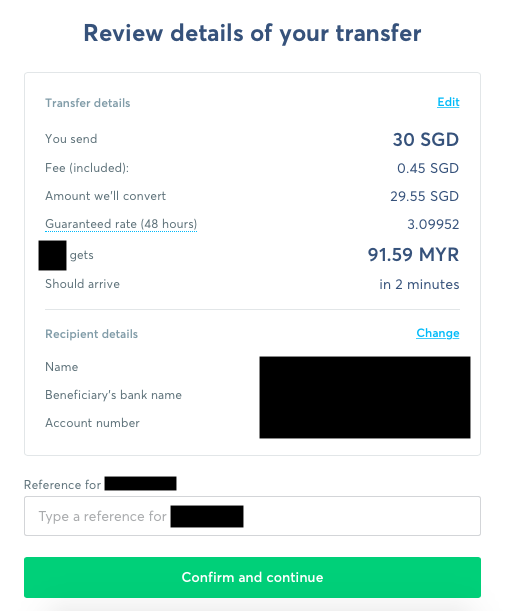

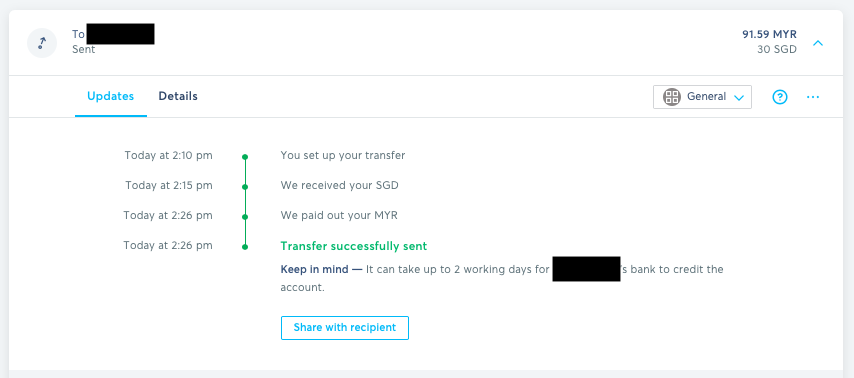

[2:10 PM] I initiated a transfer using the calculator.

[2:10 PM – 2:15 PM] I keyed in my recipient’s bank account details, went through verification, and made a transfer.

[2:15 PM] TransferWise received my funds.

[2:26 PM] TransferWise paid out the MYR funds. At this point, the money should already be in.

[2:34 PM] I asked my recipient to check his account, and the money was in.

Now, paying out the MYR funds doesn’t mean that my recipient will receive them instantly because the bank will still have to credit the funds. TransferWise says that it can take up to two working days.

However, I asked my recipient to check his bank account at 2:34 PM, and it was already in. Is it fast? To me, yes.

If you wish to see the details of this process and some hiccups along the way, you should read the next section. I included pictures of every step of the way.

Apart from my point of view, check out some of the reviews other people have written on TransferWise.

Quick Guide: How to Send Money Using TransferWise

Here’s a step-by-step guide on how to transfer money using TransferWise.

Step 1: Create an Account

Visit this page: https://wise.com

Click on “Register” and follow the simple instructions.

Registering takes about one to three minutes, and there’s an email and SMS verification.

You can also perform all these actions on the mobile app.

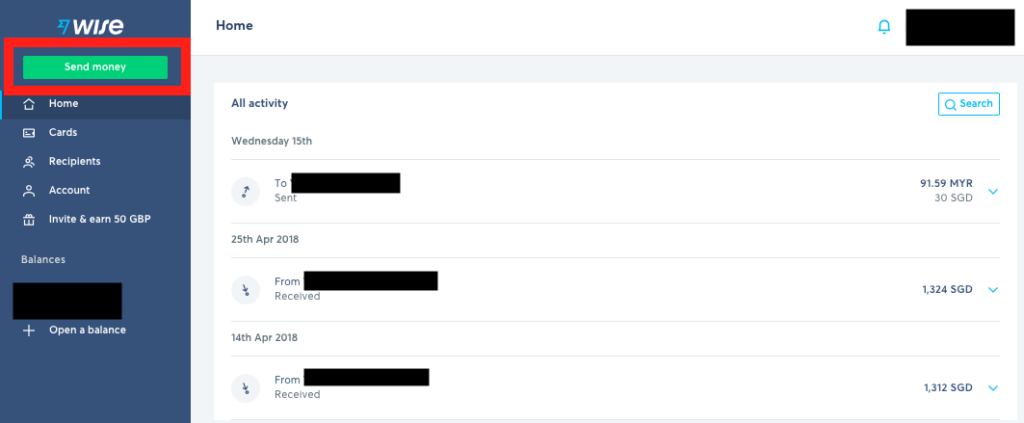

Step 2: Initiate a Transfer

In the main dashboard, click on “Send money”.

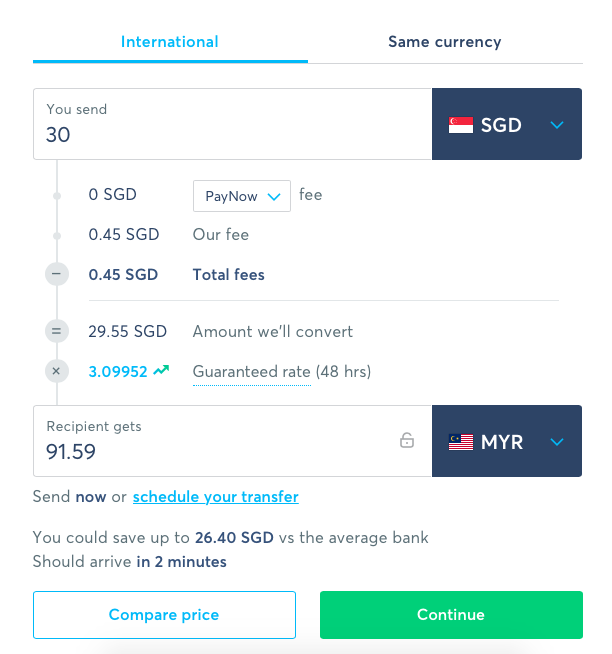

Enter the details of your transfer:

- Currency to be converted and where it should be sent

- Funding method

In my case, TransferWise stated that the funds “should arrive in 2 minutes”. This reflects the expected time TransferWise sends out the funds to your recipient’s account after you’ve made a transfer to them.

Note: the fees, exchange rate, and the amount your recipient will receive will all be exact, as long as you fund the account on time.

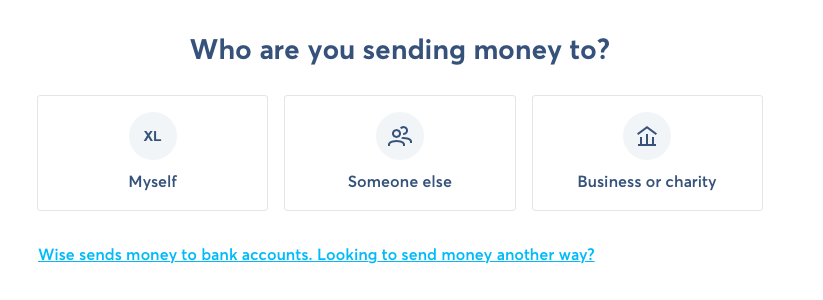

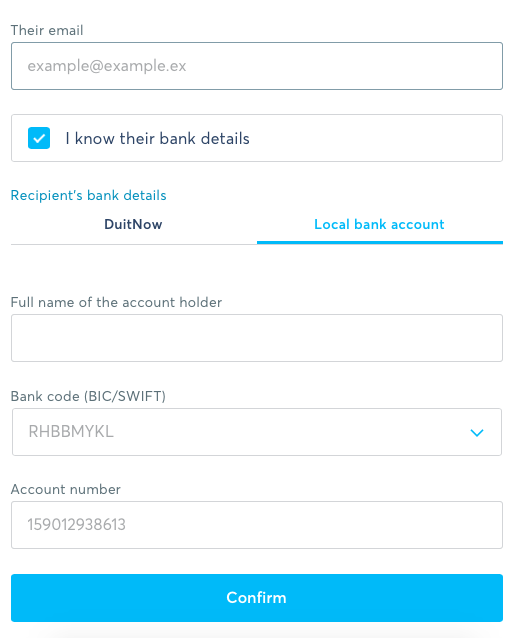

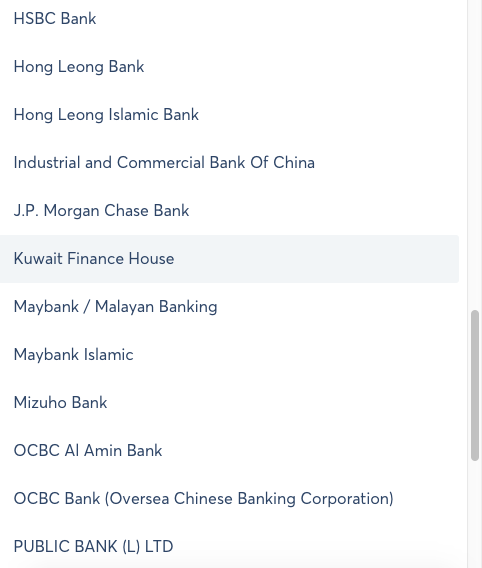

Step 3: Key In Your Recipient’s Details

Give details on who you’re sending the money to.

These details are needed:

- Full name of the account holder

- Bank code (BIC/SWIFT)*

- Bank account number

*For the bank code option, I simply selected the bank name from the dropdown menu.

You must make sure that these details are correct.

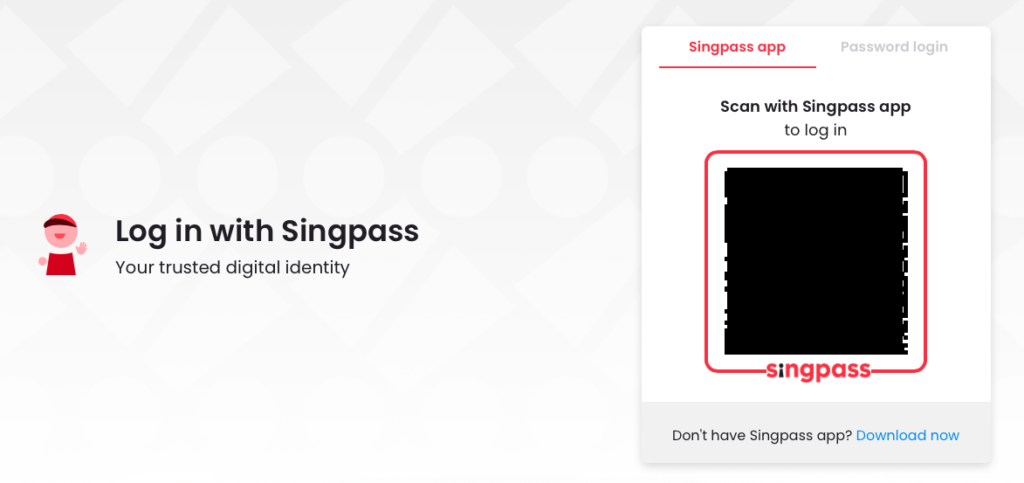

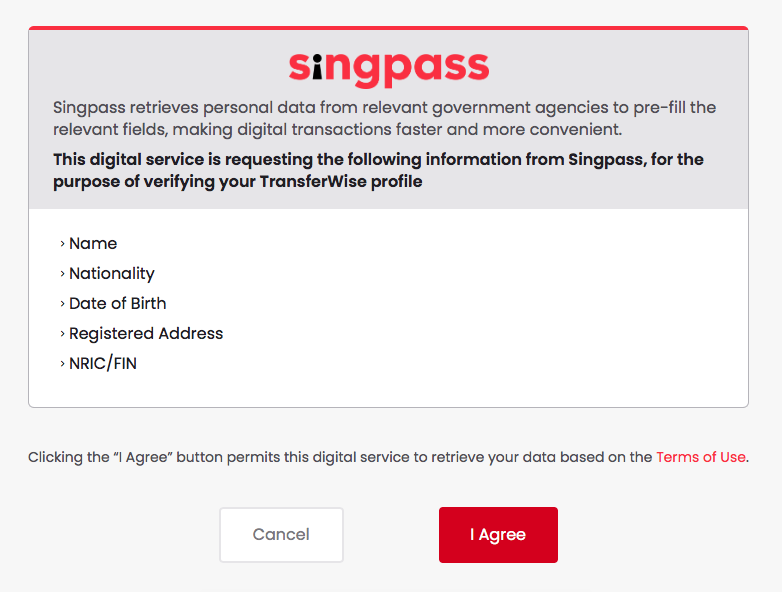

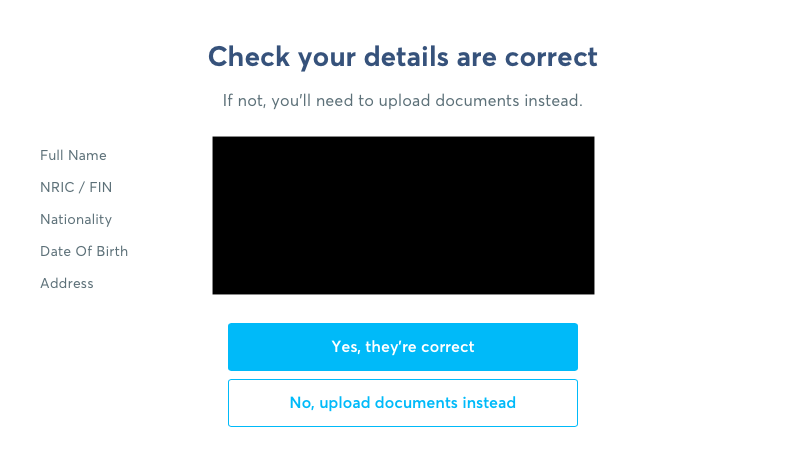

Step 4: Go Through Verification

You can either go through verification using Singpass (takes about one minute) or upload your ID (two to three working days).

Singpass is definitely the way to go (and is what I used). By following the simple instructions, you can get verified almost immediately.

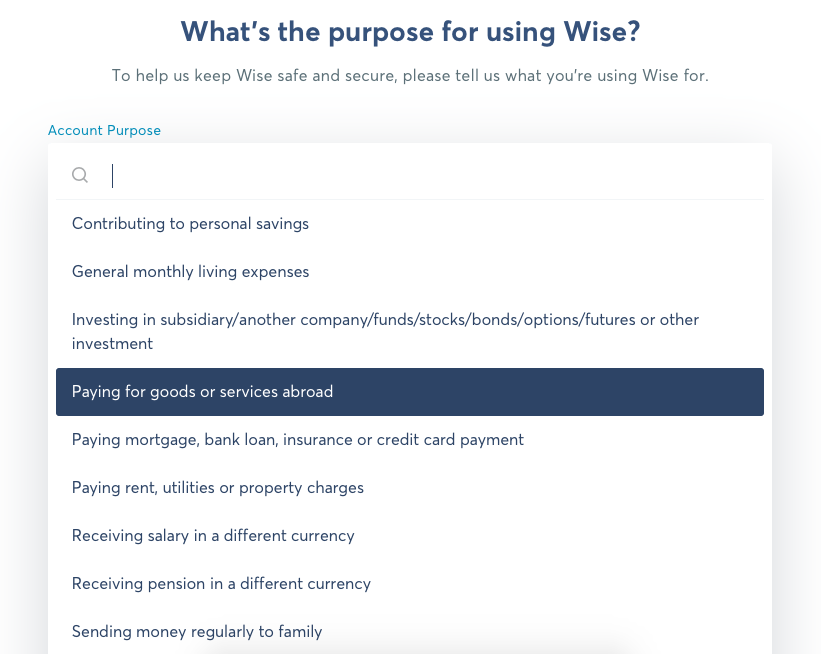

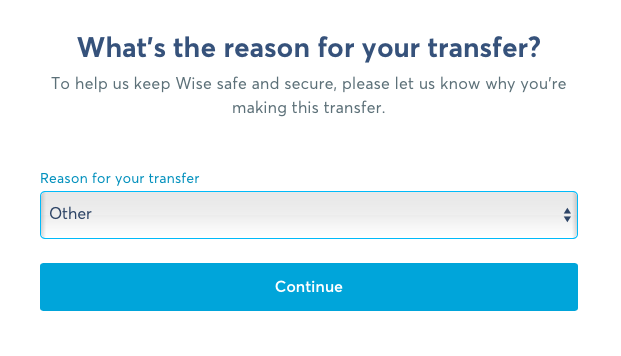

Step 5: Give a Reason for Using Wise and for the Transfer

As per the title.

Step 6: Review the Details

Check the information you’ve entered once again, especially the recipient’s details.

I left the reference field blank.

Step 7: Decide How to Fund the Payment/Transfer

You’ll be given a list of payment methods.

Bank transfer and PayNow are the recommended ones, since there are no extra costs in topping up.

I used PayNow because it’s almost immediate.

Note: whichever payment method you use, it’s important that the name matches your account.

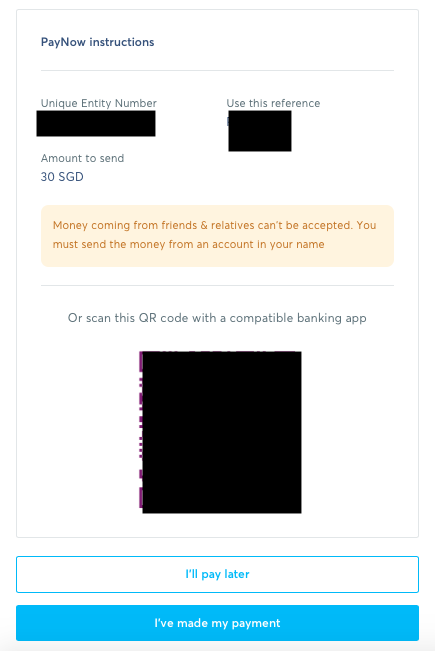

Step 8: Make the Transfer

You’ll be shown how to make the transfer, with all the details you’ll need.

You could either manually enter these details into a PayNow transfer or just use the QR code option.

I used the QR code option.

Once you’ve made the PayNow transfer, you can click “I’ve made my payment”.

Step 9: Wait for TransferWise to Send the Funds

After everything’s done, you’ll be shown a status screen.

The only thing left to do is wait.

Comments: initially, TransferWise stated that funds should arrive in two minutes, but it took them 11 minutes to send out. Do note that the recipient’s bank could take up to two working days to credit the funds.

Step 10: Confirm with Your Recipient

Ask your recipient to check his bank account after the transfer is completed.

Note: I asked my recipient to check his bank account eight minutes after the transfer was completed (at 2:34 PM), and the money was already in. It didn’t take two working days.

Follow these simple instructions and you’ll be able to send money with TransferWise in no time.

7 Pros and Cons of Using TransferWise

Here are some advantages and disadvantages of using TransferWise:

| PROS | CONS |

|---|---|

| The transfers are pretty fast | Might not always be the cheapest option |

| Safe and highly regulated | Expect delays to happen |

| Consumers can finally use mid-market rates | |

| Transparent and shows upfront fees | |

| All-in-one solution | |

Pros

1) The transfers are pretty fast

Sure, the fastest way to fund your account is to use a debit or credit card, but that comes with additional funding fees.

However, if you’re in Singapore, you’re able to use PayNow, and there are no extra charges for using it, so use that option whenever possible as it’s also immediate.

As for overall speed, the company has stated that over 30% of transfers arrive instantly, 53% of all transfers arrive within an hour, and 81% of all transfers within a day.

In my experience, the funds have reached my recipient’s bank account within 30 minutes.

2) Safe and highly regulated

I know, you want your hard-earned money to not go into scams or disappear into thin air.

This is very unlikely with TransferWise as it’s a listed company and it has to be regulated in every country it operates in.

TransferWise is licensed and regulated in Singapore by the MAS, which imposes very strict rules. The company also has to abide by rules to protect the money of the customers.

3) Consumers can finally use mid-market rates

How do you think money changers earn a profit? They simply charge a markup on the mid-market foreign exchange rate.

This is common with financial institutions, and some charge other fees too.

TransferWise gives you the mid-market rate and charges low fees. They claim to be six times cheaper than traditional banks or PayPal.

In addition, the quoted rates are guaranteed for a time period. This also means that if time permits, you can lock in that rate while waiting for better rates.

4) Transparent and shows upfront fees

What I like the most is that you don’t even need to register an account to get all the information relevant to a transfer.

By using the nifty calculator, you’re able to get the exact amount of fees you’ll have to pay, the conversion rate used, as well as the exact amount your recipient will receive.

You just need to input the numbers to see them. Easy.

5) All-in-one solution

With TransferWise, you’re able to send money to 80 countries.

But it doesn’t end there. You can receive payments like a local, hold multiple currencies, and even use the debit card for online and overseas spending.

And for businesses, even more features are added, helping them save more time and money.

Cons

1) Might not always be the cheapest option

Although you get the mid-market rates, there’ll still be fees charged.

While payment fees can be totally avoided (using bank transfers or PayNow), TransferWise’s own fees can’t.

The company does have more than 1,300 currency routes (e.g., SGD to MYR, MYR to SGD, SGD to USD). Having this huge range of routes means that it’s impossible for the company to always be the cheapest.

But I do think that, in general, the fees are cheap enough.

As long as I’m shown transparent and upfront fees and I’m agreeable to them, I’ll be a happy customer.

2) Expect delays to happen

In the transfer I used as my example, TransferWise did mention that funds “should take 2 minutes to arrive”. The actual transfer took 11 minutes instead.

Your experience could differ. It really depends on what currencies you’re using, the time of day, and whether it’s a working day or a weekend/public holiday.

TransferWise did mention that it could take up to two working days for funds to be reflected in recipients’ accounts.

After reading some other reviews, here are some things for you to take note of to reduce potential delays:

Recipient’s bank details

The information provided on your recipient must be accurate. There can be no errors.

Failure to do so, such as having a typo in the name or giving the wrong bank name/account number, will definitely lead to unwanted delays.

Verification

Proving your identity is important as it ensures there’s no fraud going on.

If you’re in Singapore, the absolute fastest way is to use Singpass as the verification is pretty instant.

However, if you choose to manually upload your ID, it’ll take slightly longer. If your ID is unclear or the details differ from your TransferWise account, longer waits will happen.

Funding your account

The last hurdle is to top up the account.

Your names from the account and the payment method you’re using must match.

You can’t use another person’s bank account/card to fund your TransferWise account. That’s going to raise some red flags.

All these details must be entered correctly. As long as you follow the instructions given by TransferWise along the way, you’ll have no problems because they’re extremely clear.

Final Thoughts

In conclusion, although TransferWise might not always be the fastest nor the absolute cheapest, in most cases, it’s fast and cheap enough for me to not look anywhere else.

And to me, that’s important. I’d rather make the transaction knowing all is in good hands, and get on with my day.

Furthermore, the easy-to-use platform, along with all that Wise can offer, only make online transfers and transactions more convenient.

If you’re still undecided, you can simply start by transferring a small amount (it can even be just $1) or breaking the full amount you intend to transfer into smaller pieces.

Disclosure: these are my own opinions. While I may receive compensation when you click links on this page, it doesn’t influence my evaluations.