The term life insurance plan used to be unpopular.

But in recent years, it became one of the key insurance policies to have.

What changed?

With medical and technological advances, the mortality (or death) rates of Singaporeans have drastically decreased over the years, which led to longer life expectancies.

Because of that, term plans now reflect a lower cost of insurance compared to decades before. This meant that you’re able to get higher coverage at a lower cost.

To add on, insurance companies are aggressively competing with each other, which meant even more affordable rates for the consumer.

In this guide, we’ll cover everything you need to know about term life insurance plans in Singapore.

So, read on!

This page is part of the Term Life Insurance 2-Part Series:

- Part 1: Guide to Term Life Insurance

- Part 2: Finding the Best Term Life Insurance

- The Purpose of Having Life Insurance

- How Much Life Insurance Coverage Do You Need?

- The 2 Plans That Provide Life Insurance Cover

- What Exactly Is Term Life Insurance?

- What Can Be Covered in a Term Insurance Plan?

- The Different Types of Term Insurance

- How Long Should You Cover Till?

- How a Level Term Plan Can Help You (Case Study)

- What's Next?

The Purpose of Having Life Insurance

Many people have varied opinions on the purpose of having life insurance coverage.

In my opinion, it boils down to this: income protection.

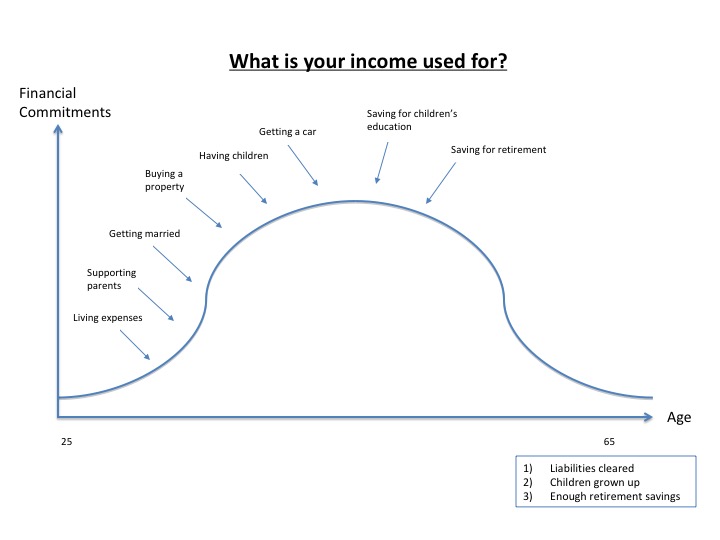

Your income is one of the most, if not the most, important financial resources you have. That income enables you to pay the bills, buy all the things you want, ensure commitments are satisfied, save for the future, etc.

Without it, everything else can’t function well.

Here are some common goals, commitments, and liabilities most Singaporeans have:

Therefore, you need to ensure your income can continuosly come in until you hit your retirement age.

There are typically two scenarios where you could lose your income:

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

1) You fire your employer or your employer fires you

This is usually temporary because you’re likely to find another job within a few months.

Even so, you should always have emergency funds on hand.

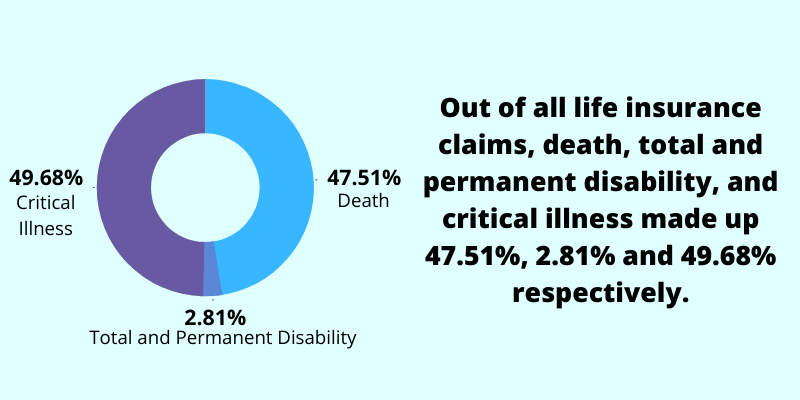

2) Death, total & permanent disability, or a critical illness happens

If any of these three events happen, your ability to earn an income will be crippled.

With a reduced or total loss of income, would you still be able to pay for all the ongoing expenses and commitments you have?

And that’s why this is the bigger concern.

To eliminate this risk, most people rely on insurance payouts to replace the potential loss of income.

How Much Life Insurance Coverage Do You Need?

After knowing the importance of replacing your income, the next step would be to find out how much life insurance is enough for you.

There isn’t any straightforward answer to this as there are many factors to be considered. It can be very subjective.

But here’s something for you to think about.

If you’re earning $100,000 a year right now, and something happens which take away your income-generating ability.

Would it be right to say you would lose the potential income you could’ve earned from now till your retirement age?

I would say so.

So, if you’re 30 years old and plan to retire at 65 years old, that would mean a “loss” of 35 years of income, which works out to be $3,500,000, not factoring in inflation or wage increments.

(To estimate how much life insurance you need, you can play around with our calculator.)

Now, this may seem like a big number, and it is. You don’t necessarily have to cover for that amount, and your budget needs to be factored in too.

Note: There are many opinions on how to calculate the life insurance coverage you need. Some may say to just factor in your current expenses, but in my opinion, there are other financial goals to cater for, such as kid’s education and retirement. So, when you plan to cover your income, or a proportion of it, you’re considering all expenses, commitments, and goals.

Ultimately, you must be comfortable with the coverage and the premiums you would be paying, after knowing the implications of under-insuring (or even over-insuring).

The 2 Plans That Provide Life Insurance Cover

The two most common plans that provide life insurance coverage are term insurance and whole life insurance.

While the term plan has a greater appeal and it’s more suitable to cover big amounts, it’s still important to bring in whole life insurance as it’s the only notable alternative.

I’ve written a more detailed article on the differences between term and whole life insurance but here’s an overview:

| Term Insurance | Whole Life Insurance | ||

| 1. | Purpose | Pure insurance protection | Some insurance protection and a savings component |

| 2. | Sum Assured | Usually much higher. Common to see $1,000,000 or more | Generally lower. But with a multiplier, it can be higher |

| 3. | Claim Payouts | Sum assured as per contract | Sum assured + accumulated bonuses (if any) |

| 4. | Cash Value | No cash value | Combination of guaranteed and non-guaranteed bonuses |

| 5. | Coverage Period | Many options available | Lifetime or till 99/100 years old |

| 6. | Premiums | Low | Higher |

| 7. | Premium Term | Typically same as policy term | Usually limited pay. Can be 20, 25 years, etc. |

| 8. | Complexity | Very simple | Slightly more complex because of the non-guaranteed bonuses |

| 9. | Flexibility | Able to cater specifically to individual needs well | Can be quite rigid. Once committed, have to stick with it |

You can learn more about whole life plans, but as this article is on term life plans, I’ll only focus on the latter from now.

What Exactly Is Term Life Insurance?

A term life insurance is a policy that provides coverage for a fixed duration (known as the policy term) and typically comes with a fixed premium.

Once the policy term ends, the coverage stops, and the plan terminates.

There’s usually no cash value in the plan, but to compensate, it provides a much higher sum assured at an affordable rate.

During the policy term, if an undesirable (and claimable) event strikes, a lump sum will be paid out, which can be used to relieve the financial burden on the insured (you) or the insured’s family.

What Can Be Covered in a Term Insurance Plan?

All term plans come with death coverage.

However, you can add on different types of coverage (known as riders) on top of the basic death cover. This allows the plan to be more comprehensive.

Here are some common types of coverage in a term plan:

1) Death

Almost all term insurance plans have this cover, and it’s pretty self-explanatory.

Of course, exclusions still apply.

For example, most term life insurance policies contain the suicide clause: “if death is caused by suicide within 1 year from the policy issue date or reinstatement date, whichever is later, there will not be a payout.“

2) Terminal Illness (TI)

Terminal illness coverage usually goes hand in hand with death coverage.

By definition, it’s the conclusive diagnosis of an illness that will lead the patient to death within 12 months.

This diagnosis has to be supported by a specialist and agreed by the insurance company’s appointed doctor.

3) Total and Permanent Disability (TPD)

Depending on the plan, TPD coverage can be either embedded in the main plan or included as a rider. The latter is more common.

Different insurance companies may have varied definitions for their TPD coverage (check the policy documents to be sure).

But as a broad definition, the name already suggests what it covers: total and permanent disability.

Here’s one specific definition:

If the Life Assured has suffered total and irrecoverable:

a. Loss of the sight of both eyes; or

b. Loss of sight of one (1) eye and loss by severance or loss of use of one (1) limb at or above the ankle or

wrist; or

c. Loss by severance or loss of use of:

i. Both hands at or above the wrists; or

ii. Both feet at or above the ankles; or

iii. One (1) hand at or above the wrist and one (1) foot at or above the ankle.

So, if you lose just just one hand, would the policy pay out? No. It’s meant to cover severe disabilities.

Some insurance companies include more definitions, such as being unable to perform at least three out of six basic activities of living (ADLs) or being unable to perform any sort of work for six continuous months.

4) Critical Illness (CI)

Critical illness coverage is an important element in life insurance too.

Statistics have shown that critical illness claims exceed death claims.

Because of this, the cost for CI cover is high.

To make CI coverage consistent and transparent, the insurance industry standardised the definitions across life insurance companies.

There are only 37 standard CIs and they’re towards the later stages of an illness. If you want to view the list of the 37 CIs and their definitions, see here.

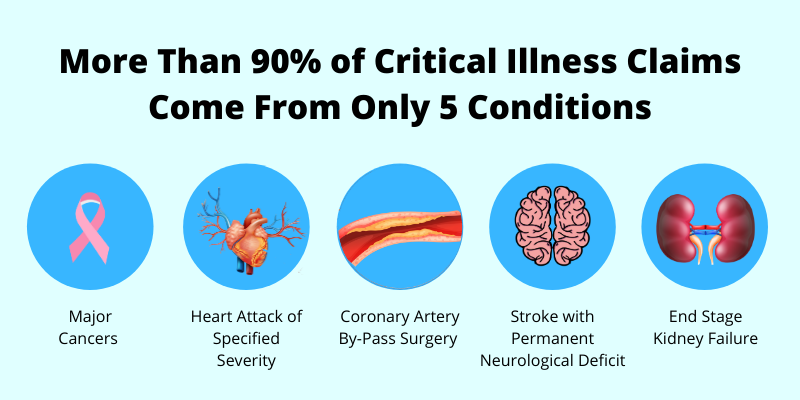

But in my view, only a few matter.

Of all critical illness claims, 90% of them are from these five illnesses:

- Major Cancers

- Heart Attack of Specified Severity

- Stroke with Permanent Neurological Deficit

- Coronary Artery By-pass Surgery

- End Stage Kidney Failure

5) Early Critical Illness (ECI)

Critical illness (CI) refers to the 37 standard illnesses, which are in the later stages.

Therefore, if you’re only covered for CI, if an early or intermediate stage of an illness happens, there won’t be a payout.

And that’s when early critical illness (ECI) coverage can bridge the gap. With it, you’re able to claim from the policy if an early, intermediate, or late stage of an illness happens.

While ECI coverage offers easier claimability, it comes with a much higher price tag compared to the standard CI coverage.

Standard CI cover is more of a neccessity as the insured is unlikely able to work after being diagnosed with an advanced stage of an illness.

Early CI cover is usually seen as a bonus as the insured could use the payout to pay for ongoing expenses, while taking a break from work for a year or two to fully recover.

The payout could also be used to pay for alternative treatments if they’re not covered under the national health insurance, MediShield Life, or the Integrated Shield Plan.

Therefore, if you have the budget, early CI can be good to have but not critical.

The Different Types of Term Insurance

Like how there are different types of apples (fuji, green, red, etc), the same goes with term insurance.

Here’s an overview of the ones you may have heard about:

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

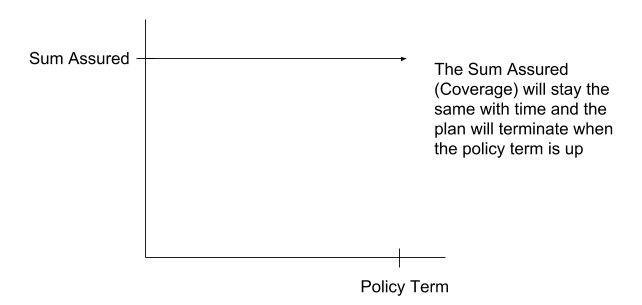

1) Level Term Insurance

This is likely the plan that most people are talking about and is the core focus of this article.

Here’s how a level term works:

Basically, the coverage stays the same throughout and only ends when the policy term is up. You can decide on the coverage amount and the length of coverage.

More on level term later on.

Get a comparison of the best term insurance in Singapore.

2) Group Insurance

If you’re an employee or have been through National Service (NS), you should roughly know what a group insurance is.

Company Insurance

Employers usually offer company insurance to their employees as a form of employee welfare benefit.

It’s great because it’s usually free, and it can be enhanced with a fee. But, why do people still get their own private insurance?

It’s because if ill-health happens, be it minor or major, and you eventually leave the company (or forced to leave), you wouldn’t be able to continue this coverage.

This could leave you in no man’s land as if you decide to apply for your own personal insurance after, the application might get declined or there may be exclusions.

That’s why most people would still get their own personal insurance even though they’re covered under their company insurance.

Singlife with Aviva’s MINDEF & MHA Group Insurance

As a NSF or NSmen, you may have known about the Singlife with Aviva’s MINDEF/MHA/SAF group term insurance.

Even after “ORDing”, you can still retain or enhance the policy.

The premiums are generally affordable but the plan comes with limitations as well, such as the premiums for the critical illness coverage increase with age-band.

Generally, the group term life benefits the older folks more because they’ll be paying the same rates as someone who is much younger.

3) CPF Dependants’ Protection Scheme (DPS)

What is DPS?

That’s the question people have when they receive a letter from CPF. It is commonly neglected because the coverage amount is fairly small (it is meant to provide a safety net).

The Dependants’ Protection Scheme (DPS) only pays out a maximum sum assured of up to $70,000 if death, terminal Illness, or total and permanent disability happens, and its cover is only till 65 years old.

From April 2021, it’s solely administered by Great Eastern, so if there’s a claim, you’ll need to approach the company.

You would be automatically enrolled into DPS if you’re a Singaporean or a PR between 21 and 65 years old and received your first CPF working contribution. The good thing about DPS is that you can use your CPF savings to pay for the premiums.

However, the coverage is usually insufficient for most.

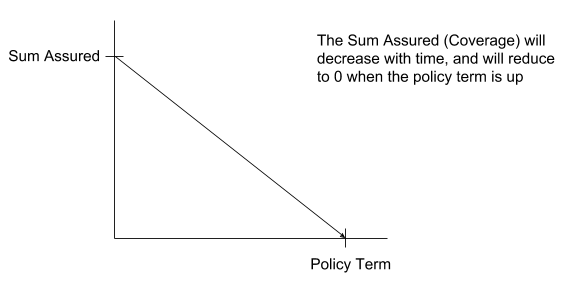

4) Mortgage Reducing Term Insurance

Mortgage reducing term insurance is also known as mortgage insurance or mortgage reducing term assurance (MRTA).

The Home Protection Scheme (HPS) belongs to this same category.

Here’s how a mortgage reducing term works:

As the name suggests, the coverage decreases every year and ends up at 0 when the policy term is over.

The rationale for this: as you’re paying off your loan, your liability decreases, reducing the coverage that’s needed. One major downside is that the premium stays fixed. It doesn’t decrease even though the coverage decreases.

Such policies were more common in the past, but is becoming obsolete because of the popularity of level term insurance. The latter could be cheaper.

5) Standalone Early Critical Illness Plans

There are standalone early critical illness plans which cover the early, intermediate and late stages of illnesses. Furthermore, they allow you to claim multiple times even if a condition reoccurs.

Such plans have negligible coverage for death and TPD. Certain companies do offer the option to include ECI into their level term plans.

If you only wish to purchase critical illness cover, then such standalone plans could be suitable.

How Long Should You Cover Till?

This question always pops up: “how long should I cover myself for?”

And that’s understandable. Term plans don’t have any cash value and will terminate after the coverage period.

Therefore, if any of the insured events happen after the expiry date, there will not be a payout. This leads to difficulties in selecting when to cover till, whether it’s till age 65, 70, 75, or 80.

This is why there are even term plans that can cover till age 99, but that’s for a different purpose altogether.

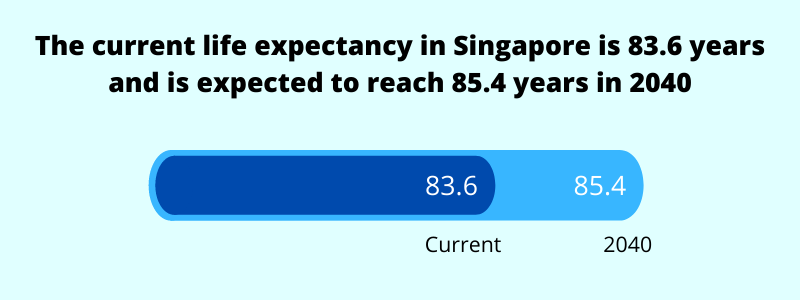

If we take a look at the average life expectancy in Singapore, it’s currently at 83.6 years and it’s expected to be 85.4 in 2040.

Does it mean that you should cover till 85?

Note: the longer the policy term, the more expensive the policy will be.

In my opinion, covering till your retirement age or retirement age plus five years is sufficient, as this period will be your income-generating years. But, if you have the capacity to expand the length of cover, then it’s all up to you.

How a Level Term Plan Can Help You (Case Study)

To illustrate the use of a term plan, it’s best to use a case study (the below information is fictitious).

Overview:

John is 35 years old and is a project manager.

He’s married to Tiffany, who is 33 years old, and is working as an accountant.

They both have two kids, Eden (three years old) and Sally (five years old). John’s parents are financially independent and don’t require any financial support.

Goals:

John views that the most precious things in his life are his wife and kids. He loves to see them play together during the weekends.

He knows that his parents are financially independent. But, because they were to ones who raised him up, he wanted to give back by giving them an allowance.

He says that most of his finances are catered for, but he wants to ensure ongoing expenses can be paid for, including saving towards his children’s university education and retirement.

Income and expenses:

John earns a gross income of $4,500 per month, taking home an amount of $3,600 after contributing to his CPF. His monthly expenses is $2,000. He has a monthly surplus of $1,600.

Assets:

- Cash Savings: $50,000

- Investments: $30,000

- HDB apartment: $450,000 (bought three years back with a current outstanding loan of $380,000, split 50/50 between him and Tiffany.

Insurance (on his life):

- One whole life insurance policy with a cover of $100,000 for death, total & permanent disability, and critical illness

- 1 hospitalisation plan (with rider)

Can John’s Portfolio (Or Yours) Be Able to Withstand the Undesirable?

Let’s play out this scenario.

As John is crossing a street near Lau Pa Sat, he received a call from an unknown number. He picked up the call but there wasn’t any response.

Slightly irritated, he hanged up the phone.

He took a step forward, not realising there was a faint red light in front of him.

“BANG.”

He got into a car accident and suffered total and permanent disability. In this situation, John might not be able to earn an income anymore.

But existing expenses (and more) still continue on. He has to rely on whatever he has left to live on.

What can help him?

1st Line of Defence: Insurance Payouts

His whole life insurance will pay out $100,000. How long would this be able to last?

Payout/Annual Gross Income = $100,000/$54,000 = 2 years.

After two years, this payout will “run out”, assuming his income is also meant for future goals, such as kid’s education and retirement.

2nd Line of Defence: Liquidable Assets

Next, when the insurance proceeds have run out, John has to liquidate all his cash savings and investments (total of $80,000), which would give him another 1.5 years ($80,000/$54,000).

With that being said, having to dip into your hard-earned money you’ve saved over the years will be painful.

At this point of time, his insurance payouts and liquidable assets will only last a total of 3.5 years.

His youngest kid, Eden would then turn 6.5 years old (3 years old + 3.5 years).

What happens after? There’s still a long way to go until Eden and Sally becomes of independent age.

3rd Line of Defence: Spouse, Family, and Friends

After his finances have run out, the last line of help will be firstly, from his wife, Tiffany.

She would’ve to take on the full burden of John’s loss of income and the family’s expenses.

In Singapore where dual income is closely becoming a necessity, would she be able to cope?

She’ll need to work doubly hard, thus spending less time with her family, and wouldn’t be able to see her kids as much as before.

If Tiffany can’t cope, there’s a need to rely on the rest of John’s family, relatives and lastly, friends.

If you’re John, would you want to see this happen?

This is a situation no one wants to experience, but may potentially face.

Fortunately, you can eliminate the financial risk of this scenario happening and be self-reliant.

With a term insurance, a much higher coverage amount can be paid out to John and/or his family.

The payout will then be able to pay for current and future expenses, commitments, and goals.

(Want to find the best term plans? Get a term insurance comparison of the top providers in Singapore now!)

What’s Next?

By setting aside a small percentage of your income, you’re able to eliminate a huge financial risk. This will give you greater peace of mind.

With a term insurance, you don’t have to constantly worry about financial uncertainties, and just go about life doing what you love to do.

This is half of the picture though.

By having a term insurance, it solves only your protection needs, the “what ifs”.

What if all goes well, then?

If your goals are to save up for your kid’s education or retirement, you’d need to allocate resources to accumulate wealth, but let’s leave that for another day.

For now, protecting your income is one of the most fundamental aspects of proper financial planning.

And there’s no better way to do that than by having a term insurance plan.

Take the first step and get yourself and your family protected by comparing and getting the best term insurance plans in Singapore.