You took the first step in contributing into your SRS account, great!

Now, what?

The funds are just sitting there collecting dust and spiderwebs (one-third of all SRS funds are sitting idle).

You know you can invest your funds but there are 2 concerns you have:

“I don’t have the time (…and the patience) to do research” and “SRS funds are my hard-earned money, I want the best for them”.

Well, you’ve come to the right place.

At the end of this article, you’ll know which option is the best to invest your SRS funds in.

We’ll also go through the various SRS approved options, the pros and cons of each, and the factors to consider in selecting one, etc.

So, read on!

The Top 7 Investment Options For SRS Funds

With SRS funds, your investment options are not as restrictive as CPF OA or SA funds.

There are many alternatives you can participate in but here are the top 7 SRS approved investments most Singaporeans invest in.

- Fixed Deposits

- Bonds

- Single Premium Endowments

- Stocks & Shares

- Index Funds & ETFs

- Unit Trusts

- REITs

Of course, the one you decide on should cater towards your risk appetite and so in this list, I’ll start from the most conservative one.

In each option, I would give you the pros and cons.

And after that, I’ll give you my opinion on which is the best…

SIDE NOTE When was the last time you conducted thorough financial planning or reviewed your finances? In this day and age in Singapore, doing so will absolutely improve the quality of life for you and your loved ones. Here are 5 reasons why financial planning is so important.

1) Fixed Deposits

Banks, be it UOB, DBS/POSB, or OCBC, have fixed (or term) deposits available

You’re able to safely deposit your money for a fixed amount of time without worrying whether it will suffer any losses.

You can also take the money out at anytime without losing your principal.

While the risks are lower, the returns correspond to it as well.

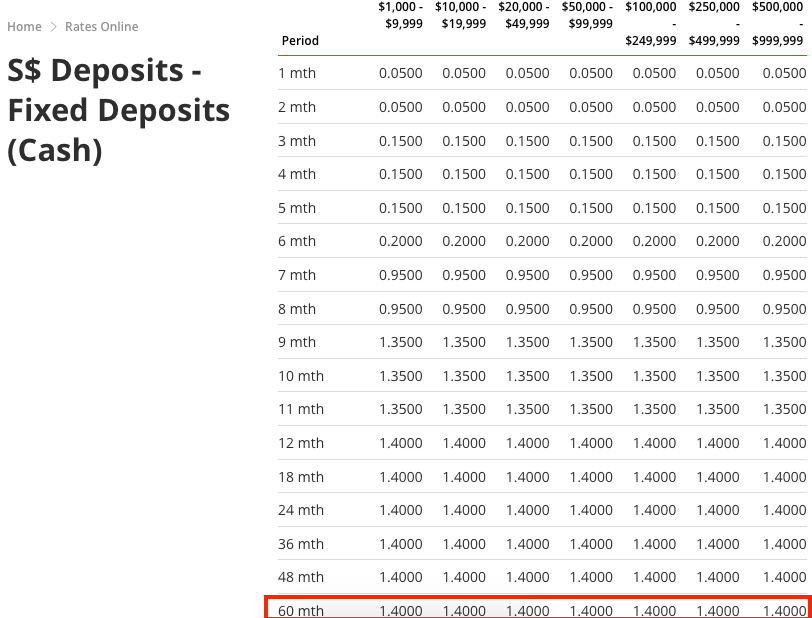

Here are the rates that DBS are offering on their fixed deposits:

You can see that the rates are low and even at the maximum term of 60 months with $500,000 – $999,999 deposited, it only gives out 1.40%/year.

Sure, you may be thinking: “yeah… but banks have promotional rates what.”

Yes they do, from time to time.

But have you thought why do they do it?

Getting more deposits allow the banks to make use of these money to make more. That’s fine and all… but the promotional rates are usually for a shorter term and these rates are seasonal. You might not be able to get the same interest rates in the future, after your deposits mature.

It can also be quite a hassle to redeem and deposit every few years till you retire.

There’s also another type of fixed deposit that links with foreign currency. Although interest rates may be higher, generally it carries more risk. So unless you know what you’re doing, it may not be advisable to go into that.

And because of the short term nature and the flexibility of withdrawing, there’s something called a “reinvestment risk” which I’ll touch on soon.

2) Bonds

To make it simple, this is how a bond works…

Say for example, a corporation or a government requires some money. It can issue a bond (like a certificate) agreeing to pay a coupon (like interest) to the person who invest in it.

Generally the coupon rate is pre-determined. And so the risk involved is on whether the bond issuer is able to pay the coupons and the principal when it’s due.

The better the credit rating of the bond issuer, the lower the returns (or the coupon rate).

While there are many types of bonds you can go into using your SRS funds like…

- Individual bonds that can be purchased from SGX

- Bond ETF Funds

- Bond Unit Trusts

All these investments can fluctuate.

But the main thing I want to touch on are the Singapore Savings Bonds (SSB) which are part of the Singapore Government Securities (SGS).

Since December 2018, you’re able to invest your SRS funds into these Singapore Savings Bonds (SSB).

How does SSB work?

When you buy a SSB, you can get interest every 6 months.

This interest gets higher the longer you hold the SSB.

But… you can only hold it till a maximum of 10 years.

Now, at any point, you can withdraw the amount you’ve invested without losing your capital.

So how are the returns?

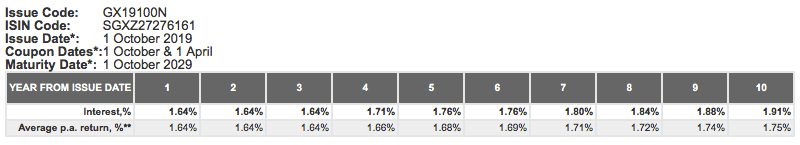

This is the bond rate for October 2019:

You can see that the Interest % increases from Year 1 (1.64%) to Year 10 (1.91%)

But the important number to take note here is the Average p.a return.

What does that number mean?

If on the 4th year, you decide to withdraw the whole thing, the Average p.a return is 1.66% ((1.64+1.64+1.64+1.71)/4).

If you hold till the end of the 10th year, your Average p.a return is 1.75%.

Important Note: As new bonds are issued every month, these numbers do change.

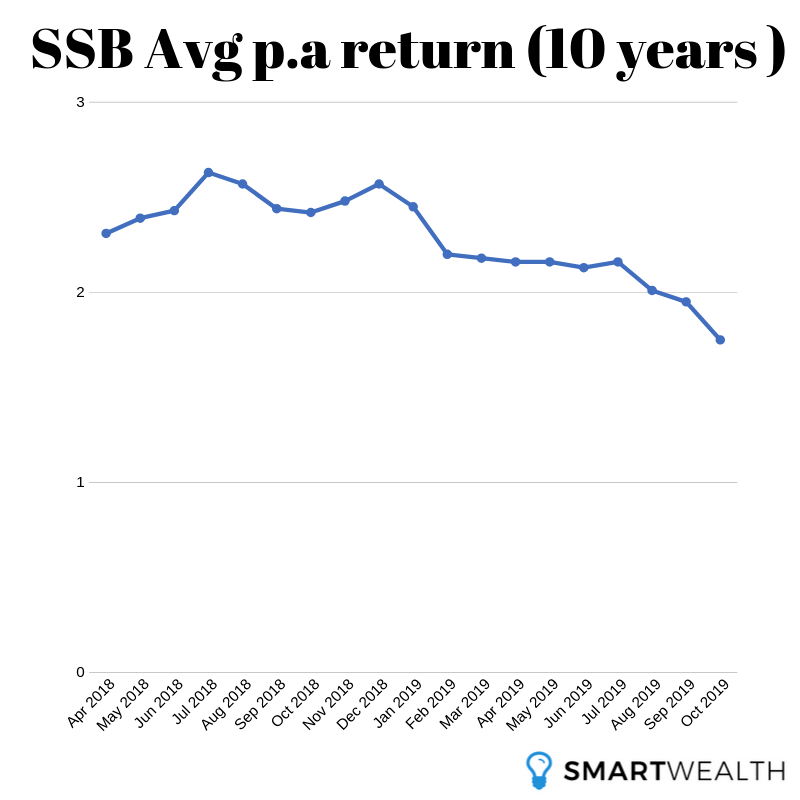

You may be wondering what are the past interest rates so I’ve chartered down some numbers for you. These numbers indicate the Average p.a return for 10 years.

| Month / Year | Avg p.a Return for 10 years (%) |

|---|---|

| Oct 2019 | 1.75 |

| Sep 2019 | 1.95 |

| Aug 2019 | 2.01 |

| Jul 2019 | 2.16 |

| Jun 2019 | 2.13 |

| May 2019 | 2.16 |

| Apr 2019 | 2.16 |

| Mar 2019 | 2.18 |

| Feb 2019 | 2.20 |

| Jan 2019 | 2.45 |

| Dec 2018 | 2.57 |

| Nov 2018 | 2.48 |

| Oct 2018 | 2.42 |

| Sep 2018 | 2.44 |

| Aug 2018 | 2.57 |

| Jul 2018 | 2.63 |

| Jun 2018 | 2.43 |

| May 2018 | 2.39 |

| Apr 2018 | 2.31 |

For the visual folks, here’s a neat graph for you:

You can see that the interest rates are trending lower… who knows what would happen in the future.

Perhaps this explains why there was a strong interest in SSB when it first came out but it died down after.

Earlier, I mentioned about reinvestment risk, and SSB do come with it.

This is how it’ll affect you…

The whole point of SRS is for you to withdraw the funds after your prescribed retirement age and that age is already set.

If you do any form of SRS investments, any redemption or withdrawal of the investments go back into your SRS account.

Now if you’ve invested in a SSB, you’ll need to redeem it after 10 years and then you’ll still need to find another way to park your money (if you’re still far from your retirement age).

How would the market be like in the future? What if the rates are lower?

These are uncertainties.

… and you’ll not be able to fully utilise the time horizon (from now till retirement age).

And that’s why the next alternative could be your best best.

3) Single Premium Retirement Endowment Insurance

a.k.a retirement plans.

a.k.a annuities

SRS endowments are offered by most insurance companies.

They fit like a glove with the structure of SRS and can offer the sweet spot between risk and returns.

What do I mean?

As SRS withdrawals usually start at 62 (or 65), you can put your SRS funds into these endowments for the full period from now till then to maximise the length of investment. And after that, you can also select a 10-year payout (most do).

SRS annuities are usually capital-guaranteed and also offer a good balance of guaranteed and non-guaranteed bonuses which target to have potential returns of 3-4% per year.

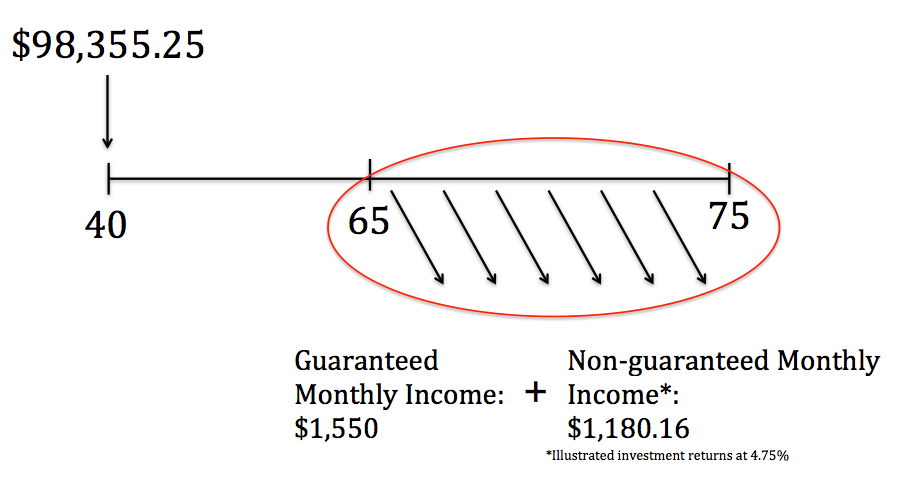

Here’s an illustration (shouldn’t be seen as a recommendation):

John whose age last birthday is 40 selects a retirement age of 65 and wants to receive 10 years of income payout from 65 to 75 years old.

He plans to set aside $98,355.25 from his current SRS balance into the plan.

At 65, he’s able to receive a guaranteed monthly income of $1,550 for 10 years.

And so his total guaranteed income he’ll receive for the 10 years is $186,000 (1,550*12*10).

That’s about double of what he has put in.

But that’s not all…

He can also receive non-guaranteed income.

The non-guaranteed monthly income (illustrated investment returns at 4.75%) he can potentially receive at 65 to 75 is $1,180.16/mth.

This makes the total non-guaranteed payout to be at $141,619 (1,180.16*12*10).

…making the total benefits to be at $327,619 (186,000+141,619).

But he only just needs to put in $98,355 now.

From that particular illustration, the plan’s guaranteed yield at maturity is at 2.15% and the total illustrated yield at maturity is at 4.10%.

Of course, terms and conditions apply.

In addition, there are several benefits to such policies.

Firstly, they’re protected by the Policy Owners Protection Scheme.

Secondly, the plans can offer extra benefits such as additional payouts if disability happens.

In the plan above, if John fails to do 3 out of 6 Activities of Daily Living (ADLs) during the payout period, he can receive an additional 100% of the guaranteed monthly income. If he only fails to do 2 out of 6 ADLs, he can still receive an additional 50% of the guaranteed monthly income.

Although there are capped amounts to the additional payouts, it offers protection if the undesirable happens so your retirement income won’t be affected.

The downside is that when you put funds into an endowment, there’s lesser flexibility for you to withdraw or surrender (there are penalties if you surrender early). However, this point is not as important because you shouldn’t even want to surrender until after your prescribed retirement age.

And that’s why SRS annuities offer an excellent option that can match the rates of fixed deposits and bonds and much more…

Want to know which is the best SRS annuity plan in Singapore?

Get a FREE comparison with quotes here.

From this point onwards…

The rest of the options have market volatility.

It means that the value of your investments can fluctuate up and down.

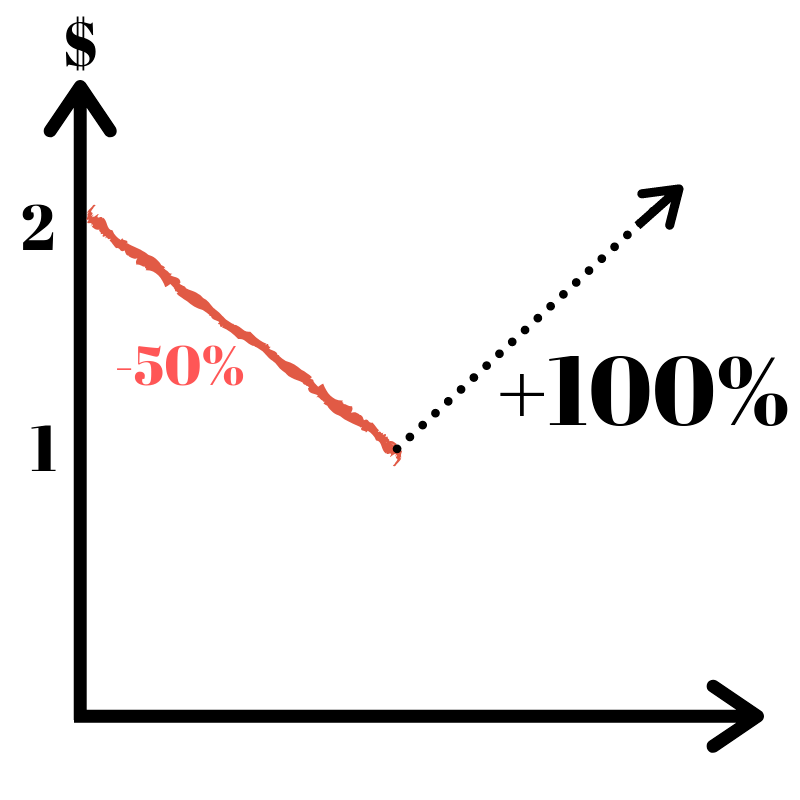

To illustrate, if you start with an initial investment of $2 and it drops to $1, you would have lost 50% of your investment.

Now at this point of $1, it will take much more to get back to the initial $2 because the investment will then need to gain 100% instead.

Therefore, the following options are meant for the risk taker.

And if you’re uncomfortable with this, the above options may be more applicable.

4) Stocks & Shares

You can buy a number of individual stocks and shares on SGX.

It can potentially give you higher returns compared to the options that we’ve discussed prior.

But at the same time…

There are greater risks involved.

Apart from market fluctuations, your investment performance depends solely on that one stock you purchased.

“Go big or go home”.

If you know exactly what to invest (through extensive research), then by all means, do so.

And just because a stock is a “blue chip”, it doesn’t mean it’ll always be stable – companies falling from grace are not uncommon.

That’s why diversification into a basket of stocks could be a better option…

5) Index Funds & ETFs

I’m going to lump the 2 together because they’re of a similar class.

When you invest in an ETF fund, you invest in a basket of goods. These goods can be equities (stocks/shares), bonds, a mixture of both, or other commodities.

These can be from a particular country or region.

This diversification makes it a better option compared to selecting a single stock as you can eliminate the risk of investing in a single bad stock.

As index funds are usually tagged to a benchmark (like STI Index), they’re a form of passive investment.

Like individual stocks and shares, you can also purchase ETFs in SGX.

Because of their passive nature, fees may be lower compared to unit trusts (next section).

6) Unit Trusts

In a unit trust, it’s also a basket of investments of all shapes and sizes.

They’re very similar to Index Funds and ETFs but have one big difference…

… they’re usually actively managed.

Fund managers rely heavily on research and select stocks they think have strong potential to be included in the fund.

Logically, by having a fund manager, it may give higher returns compared to an index fund but there’s a lot of weight on his performance. If his decisions turn out to be wrong, it can nosedive the fund’s returns.

Because of the “active” nature, the fees from a unit trust are usually higher than an Index or ETF fund.

Banks can only promote unit trusts distributed by them or their partners, which equates to a limited selection.

However, there are more funds out there in the market – 796 SRS approved funds to be exact.

Which one is the best for you?

Are you still willing to take on the risks?

Those are questions you should ask yourself.

DID YOU KNOW? According to a survey conducted by MoneySense, about 3 out of 10 Singapore residents aged 30 to 59 had not started planning for their future financial needs. This isn't surprising because personal finance can seem complicated and daunting. But really, there are only a few things that you should focus on. Learn how to significantly improve your personal finances with the 7-step "wedding cake" strategy today.

7) REITs

In Singapore, land is limited.

So anything that deals with property should be good, right?

Maybe…

As an investment, rental yields of residential properties have been declining over the years and it’s harder to rent them out now.

Even so, can you buy a residential property with your SRS funds? No.

So you’re left with Real Estate Investment Trusts (REITs) which can be bought in SGX.

With REITs, you own a share of properties (usually commercial) like office buildings and shopping malls.

Are these still viable? Let’s see…

Have you even been to some shopping malls and there are lots of vacant stores?

Or perhaps been to Jewel Changi Airport and think to yourself: “how are these stores surviving despite the high rent?”

It’s much harder to survive as a business in Singapore now because of the high rent.

Also, another reason is the introduction of technology and the internet.

You can buy clothes and everything else through online stores.

You can even buy food through mobile apps.

Everything. Is. So. Convenient.

Who wants to go to the malls?

Businesses which solely rely on physical locations are all negatively impacted.

And how would this affect you if you invest in a REIT?

If there’s low demand for these physical commercial locations, you’re forced to rent at a lower price if not these locations remain vacant (earning no income at all). This translates to you losing money on your investment.

As tech grows in the future, this issue may grow bigger.

Factors To Consider To Select The Best SRS Investment

Now you’re at the crossroads (all 7 of them). With so many options, which one do you choose?

(I’ll give my opinion after this section)

It’s not an easy choice but here are 3 factors to consider:

- Purpose Of Investing

- Willingness To Take Risk

- Ability To Hit Your Retirement Goals

1) Purpose Of Investing

Let’s go back to what SRS is…

Supplementary Retirement Scheme.

It’s meant to supplement your retirement funds so you have a stronger nest egg when you reach your golden years.

I view it as important as providing for your kid’s education.

How would you feel if funds meant for your kid’s education are put into risky assets?

You’ll feel insecure.

Because there are uncertainties… what if you lose money when it’s time to pay the tuition fees?

That’s why if you’re considering to provide for important milestones, you want to have clarity and certainty.

Which brings about the next point…

2) Willingness To Take Risk

If you have the bulk of your money in volatile investments and they’re not doing well during your retirement years, you wouldn’t want to sell them off because it’ll be a guaranteed loss.

Are you ok with your SRS funds to be at discounted at 50% during your retirement years?

Also, you won’t be sure whether it can recover.

But your retirement income has to come from somewhere and so you reluctantly sell off.

The chances of this happening can be greatly reduced.

Here’s how:

When you’re in your 20s and early 30s, you can afford to take much higher risks as you have a longer time horizon. Even if your investments take a hit, you generally have more time to pull through losses.

But when you start to get older, the time horizon gets shorter.

And that’s why most Singaporeans will start to drip-feed from volatile investments and turn to safer assets.

This allows them to fortify and strengthen their assets.

3) Ability To Hit Your Retirement Goals

For most of you who have been contributing to your SRS account, hitting retirement goals shouldn’t be difficult.

Why do I say this?

It’s exactly because you can contribute to your SRS which already means you have excess funds lying around.

Think about it…

If someone doesn’t have a surplus, do you think he’ll contribute to SRS?

Probably not.

And without a surplus, what are the chances of him hitting a healthy amount of retirement funds?

Probably lower.

So what can he do about it?

He’ll need to squeeze out some surplus by reducing expenses. And with whatever surplus he has, he’ll be forced to take on higher risks on his investments to be able to have a chance to hit his retirement goal.

But let’s come back to you.

You’re already likely to be doing something else for your retirement.

Do you need to subject yourself to heavier risk?

You can probably achieve a healthy amount of retirement funds by just investing your SRS in non-volatile options.

So which SRS option is best for you?

Why Annuities Are The Best SRS Investments (For Most)

Amongst all the options available, the SRS endowment insurance is able to fit in with the structure of SRS to best utilise the full investment period and at the same time, pay out over a regular period.

It also forms a strong foundation of your overall portfolio.

The plans are also designed specifically for retirement giving you clarity and certainty to how much you can expect to receive during your golden years.

With the plans’ unique characteristics such as being capital-guaranteed and having guaranteed yields, you need not be afraid your funds will go into the red when you need them the most.

Furthermore, you can also receive non-guaranteed returns.

All these allow you to maximise your SRS funds so you can have your desired retirement lifestyle.

What’s Next?

Knowledge is NOT Power.

Knowledge + Action = Power.

If you:

- have any questions regarding SRS endowments and want to find out more

- not entirely sure whether SRS annuities would work well with your portfolio

- want a FREE comparison and quotes of SRS endowments from different insurance companies

- apply for a particular company’s SRS plan

Take a small step by finding the best SRS endowment in Singapore here.